- Moving the markets

The markets jumped right after the opening bell powered by Boeing’s earnings and better-than-expected results from Apple and Advanced Micro Devices (AMD). However, to put this in proper perspective, only 3 stocks (Boeing, Apple, McDonald’s) are accounting for 250 points in the Dow’s advance.

It’s not that the technology darlings showed a superior report card, no, it was a sigh of relief rally that the outcomes weren’t as bad as had been anticipated. After all, Apple saw not only a decline in revenue during the Holiday quarter but also a reduced sales outlook for the current period.

Also helping the bullish mood was ADP’s January jobs report noting that 213k jobs were added in January vs. 181k expected. This number by itself can give us a sense as to what the government employment report due out Friday is likely to show, although these 2 reports do not always move in sync over time.

Then it was the Fed’s turn to shine, which was akin to surrendering to the markets with this statement:

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

According to Goldman Sachs, there are some of big changes, that popped up unexpectedly:

The FOMC adds “patient” rate outlook amid muted inflation and global developments and introduces flexibility in balance-sheet normalization.

The Fed removes a statement about “some further gradual increases.”

The line about “balance of risks” is also removed, replaced by a line about policy “patience amid muted inflation and global economic and financial developments.”

However, the surprise came when the Fed subsequently revealed this bon mot:

The committee is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments.

Wow! What a turnaround from the hawkish viewpoints expressed in December by Fed head Powell. The simple translation: We will accommodate the markets in whatever form we can by not hiking rates as planned and stopping our balance sheet reduction, if necessary.

In other words, it looks like the -14% 4th quarter 2018 loss in the S&P 500 caused the Fed to get cold feet and reverse course. For us trend followers it means that the likelihood of the bear market coming to an end just increased, and a new bull market may be on deck and begin soon.

Our Domestic Trend Tracking Index (TTI) confirms this view as it is currently positioned only -1.06% away from breaking its trend line to the upside and generating a new ‘Buy’ signal.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

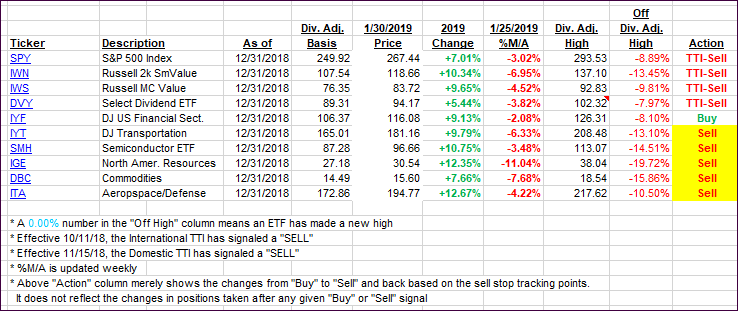

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates from the last cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) moved sharply with especially the Domestic one homing in on a trend line crossing to the upside.

Here’s how we closed 01/30/2019:

Domestic TTI: -1.06% below its M/A (last close -2.07%)—Sell signal effective 11/15/2018

International TTI: -1.53% below its M/A (last close -2.49%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

Contact Ulli

Comments 7

Hey, Ulli

In today’s Successful Investment Newsletter, you said, “The simple translation: We will accommodate the markets in whatever form we can by not hiking rates as planned and stopping our balance sheet reduction, if necessary.” Would you be willing to consider the incentive of the Fed might just be to maintain the current rate of economic activity irrespective of the direction of the stock market?

Smokey

1/30/19

Author

Yes, I am considering it, but it’s no longer reality. Please review today’s post for more details.

Ulli…

Do I interpret your response as a negative, meaning the Fed only cares about market prices and nothing about maintaining a growing economy? Do I also conclude as fact that given the market was down in December; up in January the market is not freely traded? Guess I’m a little slow, today.

Smokey

1/31/19

Author

My response was meant to be neutral by accepting the Fed’s mandate but at the same time being aware that they caved to Wall Street and may have become politicized. Yes, the markets have not been traded freely in a long time, which most investors have not realized yet.

Otherwise, how do you explain the Fed’s stance from September by announcing that their balance sheet reduction (QT) is on auto pilot and interest rate hikes for 2019 were to be 3-4. Then we had a market collapse, and the Fed did a 180 causing the markets to reverse. They got cold feet and are clearly having their number one priority to be market stability.

Hey, Ulli

How would I explain it? Simply that the Fed’s board recognized the economy’s need for a light foot on the brakes in order to continue it’s growth at an acceptable rate. But I see today that you have doubled down with your comment about “…the Fed’s slamming on the monetary brakes and caving to Wall Street…”.

You’re a cynical man, Ulli! ;o)

Smokey

2/1/19

Author

Yes I am…. 🙂

Author

Thanks for the suggestion, but I prefer reporting issues as I see fit. You can always read MSM, if that better aligns with your thinking…