ETF Tracker StatSheet

You can view the latest version here.

EDGING HIGHER ON HOPE FOR U.S.-CHINA TRADE PROGRESS

- Moving the markets

While the major indexes traded above their respective unchanged lines throughout the session, a late push higher appeared to put an exclamation mark at the end of the day, as if to imply that the U.S.-China talks better result in a positive outcome.

Still, the gains were modest, as traders are anxiously awaiting tomorrow’s meeting between Trump and Xi in Japan as part of the G-20 powwow. With threats and conditions having been thrown back and forth, I don’t see much headway being made. After all, for Trump to declare that he made the best trade deal ever, the Chinese would have to admit defeat, and that is not going to happen.

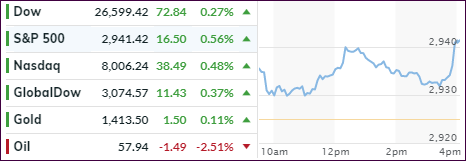

In the end, the month of June proved to be the “comeback” month of the year with the S&P 500 gaining some +6.87%, its best performance since 1955. While that sounds great on the surface, let’s not forget that the index lost -6.59% in May. In other words, we’re about back to where we were on April 30th, namely 2,946 vs. today’s close of 2,941.

Looking at a bigger time frame, like the past 17 months, we see in the following chart that the S&P 500 peaked at 2,873 in February 2018 and closed today at 2,941. That is a jaw dropping return of +2.37%:

Read More