- Moving the markets

Early weakness in equities prevailed throughout the session, but downward momentum accelerated leaving the major indexes in the red with the Nasdaq taking the brunt of the beating.

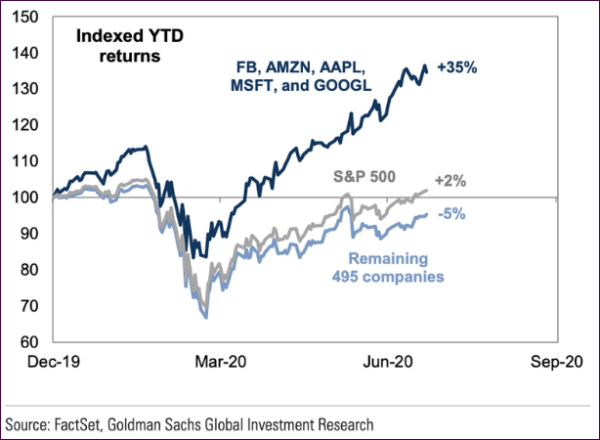

As we all know, the tech sector has been on a tear, so corrections are to be expected. Look at this chart below showing the dominance of tech within the S&P 500 composition:

What this demonstrates is downright mindboggling: The five largest stocks have returned 35% YTD; the other 495 stocks have declined by 5%. And as a composite, the S&P has gained +2% YTD!

Late in the session, the slide stopped, in part due to some Fed intervention, as ZH pointed out tongue-in-cheek:

Well, it took it’s sweet time, but at exactly 2:30pm the Fed fired a warning shot at all the racist criminals known as “sellers” when it announced that it had “broadened the set of firms eligible to transact with and provide services in three emergency lending facilities.”

… apparently the Fed decided that the only reason there is not even more demand, is because the program is too… limiting, and so it decided to expand the list of counterparties. The signal was clear: any more selling and the Fed starts buying stocks.

Today’s timeline of events was as follows:

0830ET *FIRST RISE IN INITIAL JOBLESS CLAIMS SINCE MARCH

1035ET *FLORIDA POSTS RECORD 173 DAILY VIRUS DEATHS AMONG RESIDENTS

1320ET *HOUSE ANTITRUST PANEL TO EYE AMAZON, APPLE, FACEBOOK, GOOGLE

1335ET *APPLE FACING MULTI-STATE CONSUMER PROTECTION PROBE

But then, in a panicked moment from The Fed as losses accelerated, the collapse stalled as this hit…

1430ET *FED BROADENS FIRMS IT WILL TRANSACT WITH ON THREE LOAN PROGRAMS

We will find out tomorrow if the Fed’s signal was received and accepted, or if the bears continue to have another day in the limelight.

Read More