ETF Tracker StatSheet

You can view the latest version here.

MAINTAINING THE BULLISH BEAT

- Moving the markets

Despite a slowdown in upward momentum this week, equities squeezed out another win with the S&P 500 gaining +0.71%, which may not be impressive but indicates continued bullishness, even though we saw some choppy and sloppy trading.

In economic data, we learned that the purchasing managers indexes for August were better than expected, and sales of existing homes rose for the second month in a row with the median price breaching $300k for the first time ever. This was caused by low mortgage rates and substantial moves by those who could from cities to less densely populated areas.

On the other hand, this may have been a temporary phenomenon with mortgage applications stalling in July and August due to the slowing recovery and a weak labor market.

All the above combined to keep the indexes levitating higher, after some clinging to their respective trend lines early on.

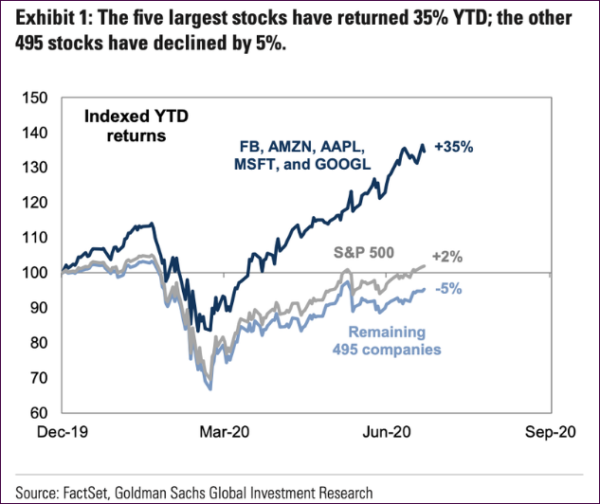

It’s been no secret that most of the gains this year have come from the tech sector, and more specifically from 5 of the largest stocks. The below chart clearly shows the lopsidedness of this rally:

The result is truly amazing when considering that without the tech rulers, the S&P 500 would still be down YTD. Makes me wonder how long this can go on, but it also supports my view that an exit strategy is vitally important, should this divergence suddenly come to an end.

Much has been made in the financial media about the rotation from Growth into Value, but that theme only lasted a few days, as Growth came roaring back and scoring new highs in the process.

At the same time, bond yields headed lower, the US Dollar moved higher and spot Gold stayed about even, but GLD slipped -0.80%.

This week was a choppy one, but we might see more of a slowdown over the next few trading sessions with some traders being on vacation, as we head into the dog days of August.

However, on the agenda, and eagerly awaited, is the Fed’s annual Jackson Hole meeting, which will conclude next Thursday and could provide us with important policy announcements—or not.

Read More