- Moving the markets

The first part of the session showed the bulls clearly in charge when suddenly Brexit concerns hit the headlines, which was followed by news that the Democrats voted to block the Republican’s stimulus bill. That was enough send stocks, bonds, and gold diving, while the dollar enjoyed a rebound rally.

ZH summed up the 3 things that kept the bullish dream alive in the last few weeks:

- The Fed – hasn’t bought any HY/IG bonds in a while and balance sheet flat

- Stimulus – fail on any further deal (McConnell Senate comments and skinny bailout bill didn’t pass Senate)

- Vaccine – the AstraZeneca news did not help

The Nasdaq swung wildly between +1.5% and -2% causing one of our tech ETFs, which had been bouncing against its trailing sell stop point, to break through it, giving me a reason to sell it and take profits. The index has now moved back into correction territory, and we’ll have to wait and see if this was just another flesh wound, when compared to the recent enthusiasm, or if there is more injury to come.

At this moment, yesterday’s rebound looks like a dead cat bounce, but we are living in such uncertain times where anything is possible, so it pays to be more cautious and take some money off the table.

The much hoped for rotation from growth to value has not worked out so far, as both seem to be moving in sync.

Not helping the mood were Jobless Claims with the Initial ones staying about even with last week, while the Continuing Claims rose week-over-week.

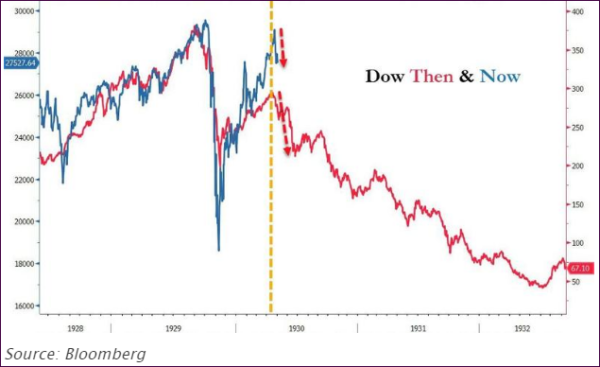

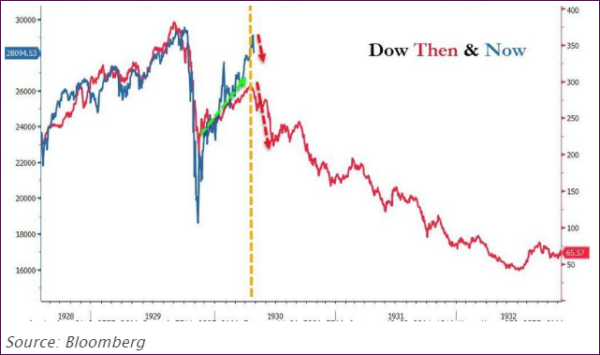

All this brings back the question as to whether the analog to 1929 is still valid. So far, it’s a remarkable development: