- Moving the markets

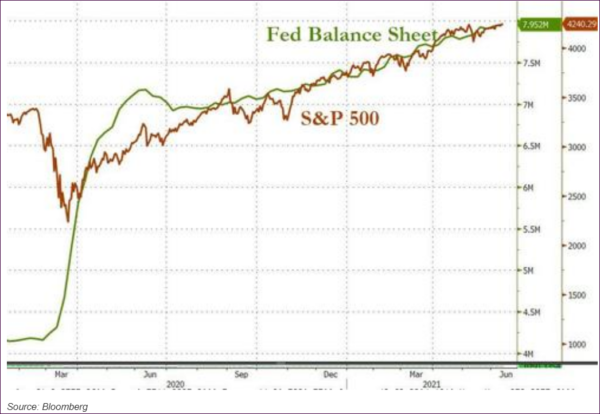

Despite the Fed leaving interest rates unchanged for the time being, it was the outlook that disturbed the bulls today. Inflation expectations were raised to 3.4% for 2021, which is 1% higher than the March projection.

The time frame as to when rate hikes might occur was moved to 2023, during which two increases are now projected. That came as a surprise after March’s announcement that such action may not be on deck until at least 2024.

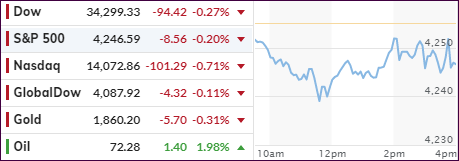

The broad market dumped, including all 11 S&P sectors showing red numbers at one point, and there was no escape to safety. Apparently, beliefs were that the Fed would sit on its hands, so today’s hint that rates will need to rise sooner and faster, came as a surprise.

Regarding the Fed’s monthly $120 billion bond buying program, designed to keep bond yields low and make debt service feasible, no changes were announced.

The fallout was instant, as the US Dollar surged and bond yields rose, which caused stocks to tumble and Gold to dive.

The big question is this one: “Can the markets absorb this news without much damage, or will sentiment favor the bears from hereon forward?”

We will find out over the next few days.

Read More