I again got stuck with some appointments and will not be able to write today’s market commentary. However, the weekly StatSheet will be published tonight by 6:30 pm PST.

Regular posting will resume tomorrow.

Ulli…

I again got stuck with some appointments and will not be able to write today’s market commentary. However, the weekly StatSheet will be published tonight by 6:30 pm PST.

Regular posting will resume tomorrow.

Ulli…

Despite an initial jump after the Fed’s dovish FOMC statement, during which Fed head Powell hinted that “substantial further progress” would be necessary before any type of tapering, hiking, or tightening would occur, markets slumped. He was referring to stronger job numbers and advances towards maximum employment. Strangely enough, the Fed did not appear to be worried about soaring inflation. Go figure…

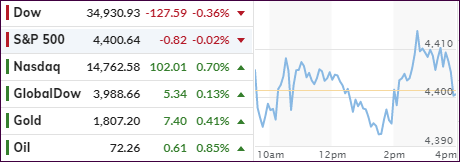

The markets ripped while the US dollar dipped after the announcement, but apparently the bullish impact proved to be ephemeral, with the major indexes giving up their gains and ending just about unchanged. The exception was the Nasdaq, which held on to its advances.

The tech assist came from Alphabet, which posted good quarterly results with especially its advertising revenue jumping 69%. Also helping the tech sector was a rebound in the Chinese markets after 3 days of relentless pounding.

A short squeeze aided traders as well, but in the end only a select few managed to post green numbers. Small Caps (VBK) took the lead with a 1.42% gain, while “value” just about broke even.

Bond yields popped and dropped with the 10-year ending the session unchanged, when the Fed’s early hawkish interpretation turning into a dovish one thereby sending bonds on another roller coaster ride.

Finally, the collapsing US Dollar, and a sideways trending bond market, pushed Gold higher and back above its $1,800 level via a 0.50% gain for the GLD ETF.

And, if Bloomberg’s post-FOMC pump pattern, as presented by Zero Hedge, remains true, we are in for a correction followed by another run higher, as this chart demonstrates. Unless, of course, seasonal weakness sets in.

Read More

A couple of forces combined to slap the major indexes around until, late in the session, the markets found some footing and managed to reduce the early losses.

Leading the charge to the downside was what appeared to be the bursting of the tech bubble in China, with its Hang Seng Tech index having been sliding down a slippery slope since early this year (-43%).

When charted vs. the Nasdaq, similarities emerge making the already nervous Wall Street traders wondering whether this current disconnect is an advance warning of things to come here in the US.

While the answer is unknown, it was enough of an uncertainty to rattle the markets. Not helping matters, and accelerating weakness, was the latest in “science” after ‘Delta’ Masking headlines appeared and shrugging off all that had been settled before.

That proved to be unsettling for stocks, which made intra-day lows and contributed to the Nasdaq’s biggest daily drop since early May, as ZeroHedge reported. Small Caps were trounced at the rated of -1.14% (VBK) with the ETF faring far worse than its value cousin (RPV), which only bled -0.11%.

Not to be outdone, the US Dollar index dove in unison with bond yields, with the 10-year heading towards the 1.22% level. Gold worked both sides of its unchanged line and managed a meager yet green close (+0.18%).

On the earnings front, the tech heavyweights Alphabet, Microsoft, and Apple all are reporting this afternoon.

On deck tomorrow will be the result of the Fed’s latest two-day meeting, but expectations are for no earth-shaking announcements but more of the same rhetoric we hear every month.

Read More

Touching new all-time highs seems to be a regular occurrence, and today was no exception with the S&P 500 hovering again in record territory.

That came as a surprise, as in overnight trading the Chinese tech stocks were a bloodbath again, as Beijing’s crackdown intensified. So far, the US markets seem to be ignoring it and continue dancing to the beat of their own drummer.

Expectations are that, with the busiest earnings week on deck, results will remain market pleasing hence the run higher ahead of actual outcomes. The well-known adage “buy the rumor, sell the fact,” may be proven correct again.

Despite jawboning to the contrary, the economic recovery remains doubtful at best with sales of US single family homes dropping unexpectedly in June, falling 6.6% to a seasonally adjusted rate of 676k units vs. expectations of an increase to 795k units.

In terms of market behavior, we saw the US Dollar index slipping, along with Small Caps, while value (RPV) outperformed with a +0.94% gain. The 10-year bond yield did its own interpretation of a roller coaster ride but ended unchanged.

Gold struggled all day and lost its $1,800 level, but only by a small margin with even collapsing yields not being able to prop up the precious metal. The Nasdaq just about broke even, but that may change with some of the tech titans report cards waiting on deck.

Read MoreBelow, please find the latest High-Volume ETF Cutline report, which shows how far above or below their respective long-term trend lines (39-week SMA) my currently tracked ETFs are positioned.

This report covers the HV ETF Master List from Thursday’s StatSheet and includes 312 High Volume ETFs, defined as those with an average daily volume of more than $5 million, of which currently 260 (last week 252) are hovering in bullish territory. The yellow line separates those ETFs that are positioned above their trend line (%M/A) from those that have dropped below it.

Take a look:

The HV ETF Master Cutline Report

In case you are not familiar with some of the terminology used in the reports, please read the Glossary of Terms. If you missed the original post about the Cutline approach, you can read it here.

ETF Tracker StatSheet

You can view the latest version here.

GAINING ALTITUDE

After Monday’s dump, which by now has long been forgotten, the bulls stepped up to the plate with the major indexes scoring four winning days in a row along with record closes.

The overpowering economic concerns from earlier in the week gave way to unbridled optimism, as bond yields rose from a five-month low of 1.13% for the 10-year to a current 1.285%. Traders took that as sign that things were overblown, and that inflation does not appear to be as much of a threat as it had been in the 70’s and 80’s, a viewpoint that I disagree with.

Be that as it may, right now the bulls are in charge with additional support coming from strong earnings in the tech sector with 88% of all S&P 500 members having reported a positive surprise. That is the highest percentage since 2008, if that figure holds throughout this earning season, according to FactSet.

The short squeeze of the first three trading days faded and had no effect over the past two sessions. Bond yields meandered on the day with the 10-year creeping above the 1.30% marker but failed to hold that level. Gold slipped a tad but managed to hang on to the $1,800 level, while the US Dollar Index trod water.

Given the horrific start of the major indexes to this week, ending up with +1.95% for the S&P 500, +2.8% for the Nasdaq and +1% for the Dow is a recovery worth remembering.

Read More