- Moving the markets

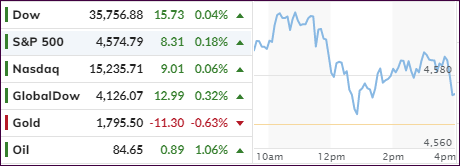

All good things must come to an end eventually, and today we saw the reality of that quotation when, after an early march higher, upward momentum faded causing the rally to lose some steam. The major indexes put up a good fight but ended the session modestly in the red with the Nasdaq faring the best by closing unchanged.

It’s worth noting that the value to growth rotation continues, as the value ETF RPV got hit hard and surrendered -2.02% vs. the growth ETF RPG, which only gave back a scant 0.15% in the last few minutes of trading.

Two of the tech heavyweights performed well after reporting stronger than expected earnings, with Microsoft and Alphabet each jumping 5%, as the former showed the fastest revenue growth since 2018. It was opposite day for Twitter, which got spanked at the tune of -9%.

Still, optimism runs rampant with LPL’s chief financial strategist calling the remainder of the year like this:

We see signs that there could be more gains to come in the final two months of the year. Seasonal tailwinds, improving market internals, and clear signs of a peak in the Delta variant all provide potential fuel for equities heading into year-end, and we maintain our overweight equities recommendation as a result.

The US Dollar again pumped, dumped, and pumped but stayed within its recent trading range. Bond yields on the long end dropped sharpy with the 30-year sinking below its support level and the 10-year showing a similar move down to 1.541%.

As a result, Gold found some momentum and headed higher yet was unable to reclaim its $1,800 level, which has been a glass ceiling for a while. However, given the inflationary undertones, I anticipate this ceiling to be shattered soon.

US economic growth expectation have plummeted, according to the Atlanta Fed, which indicates that we are getting close to contraction. The dreaded “S” word, as in stagflation, has been pulled onto the front burner making me ponder: “How can equities continue to go up when growth is stalling?”

Hmmm…

Read More