ETF Tracker StatSheet

You can view the latest version here.

WALKING BACK THE TOUGH TALK

- Moving the markets

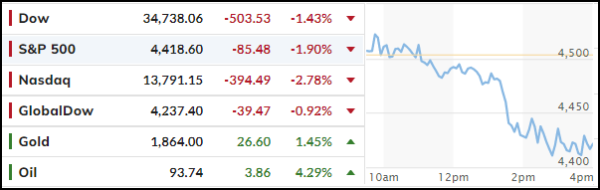

It’s been a wild ride during the past 24 hours, since yesterday’s horrific CPI release, which indicated that we now have the highest inflation in 40 years. Not helping the markets were subsequent comments by the Fed’s mouthpiece Bullard, who called for 0.5% rate hike and an active sale of the Fed’s securities, thereby sparking panic, and helping the sell-off in the process.

Today, his remarks, which certainly added a sense of realism and urgency, were rebuked by various Fed speakers, and the media, as having been “immature” and “unprofessional.” So, damage control went into full swing and helped the major indexes early on to gain some footing, but in the end the sell-off persisted also due to war drums being beaten in the Ukraine.

Added ZH:

A sudden slap to the face seemed to shock investors from their multi-month stupor, waking to the reality that The Fed is serious this time about raising rates and withdrawing liquidity. That realization, considering US equity valuations have never been higher (combined with a collapse in US consumer confidence) have many wondering just where (or if) these two lines will ever converge…

Bond yields were caught on a high speed rollercoaster with the 10-year up 15 bps yesterday and down 13 bps today, as rumors of Russia’s imminent invasion made headline news. The US Dollar rode the news cycle up and down and ended the week a tad higher.

During all this turmoil, gold benefited and surged above the $1,860 level, its highest since Thanksgiving, according to ZeroHedge.

We are having a major power outage in my area, so I had to “wing” this report on my backup equipment.