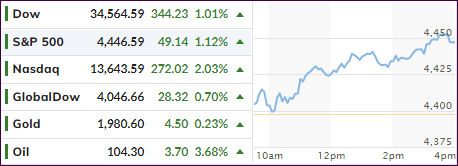

- Moving the markets

Today was comeback day with the S&P 500, after having fallen for two straight weeks, finally receiving a boost, along with the other major indexes, to end the session in the green. The Nasdaq led the charge with a gain of over 2%.

Some analysts contributed this bounce to sentiment and positioning as having been too bearish, hence a bullish response resulted, also because of better-than-expected bank earnings with Citizen’s Financial jumping more than 7%, while powerhouse JP Morgan added a more modest 2%.

A few tech and media companies like Disney (+3.8%) and Netflix (+3.7%) joined the party, while Microsoft and Alphabet each gained over 1%. “Despite recession concerns, the underlying economic data have been holding up fairly well,” added a strategist at Edward Jones.

Still, this solid rebound was astounding for two reasons:

- It happened in the face of a continued surge in bond yields. The 10-year added almost 8 basis points (bps), to close the session at 2.94%, with the 3% level now in striking distance. It remains to be seen whether a break above it will bring bearish sentiment back in play.

- The world as a whole and the IMF have slashed global growth outlooks, slamming crude oil lower, while Fed mouthpiece Bullard threated with 75 bps hikes instead of the previously announced 50 bps.

Traders and algos did not care, and the rally was on thereby erasing some of the recent losses. And, as you might have expected, the ever-lurking short squeeze gave an assist and helped sustain the bounce into the close.

With yields heading higher, the US Dollar followed suit and reached its top level since June 2020, according to ZH. Gold was the victim of the dollar and bond yield surges and gave back some of its recent advances.

Read More