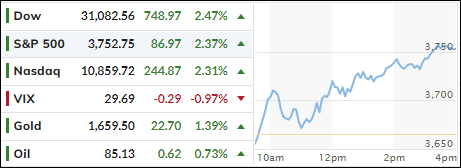

- Moving the markets

Plunging bond yields provided the perfect background to keep the bear market rally intact for the third day, a scenario we’ve witnessed several times this year. The largest drop and subsequent rebound happened in June, when the S&P 500 exploded off its bottom by 19.2% only to shift in reverse and surrender all gains:

While we may see a similar pattern play out again, the big unknown here is the Fed and its “anticipated” (not announced) intentions. If in fact they pause or pivot, we will likely see this bear market rally turn into a new bull market, which will then get us trend trackers back into equities.

Jumping in any time prior to our Trend Tracking Index (TTI) breaking its trend line to the upside is like trying to catch a falling knife, and we’ve witnessed how that idea ended up in nothing but financial pain on six occasions this year. As tempting as it may be, it’s wiser to let a bullish trend establish itself before pushing the Buy button.

The fact that earnings estimates have been reduced by analysts allowed companies to fare better than anticipated, thereby proving some support for the current rally, despite decreases in 2023 forecasts. And, of course, a short-squeeze was activated and contributed to the melt-up.

On the economic side, we learned that Consumer Sentiment tumbled with current conditions crashing to 18-month lows, as ZeroHedge reported. Real estate news was just as ugly, as home prices plunged the most since 2009, but fear not, any bad news was seen as good news for the markets—at least for this day.

The US Dollar dropped to 3-week lows, which benefited gold, and the precious metal gained some ground but has a way to go get back to its old highs.

In terms of earnings, the big boys are on deck with Alphabet and Microsoft due out this afternoon, which is followed by Amazon’s and Apple’s report cards on Thursday.

Read More