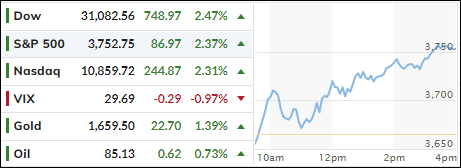

- Moving the markets

Despite a rollercoaster ride in the futures market overnight, and a plunge in the Chinese stock market of -6.4%, its largest one-day drop since 2008, US sentiment remained positive after the opening bell rang.

It’s all about earnings and forward guidance this week, with 46% of S&P members reporting. However, inflation data and bond yields will always be on centerstage with traders now “whispering” that the Fed might be stepping off the gas pedal regarding their hiking pace with a “pause” to be hopefully on deck.

All the above is not based on facts, but merely wishful thinking, but so far it has had the desired effect of keeping the bullish theme alive. We have seen this pattern numerous times this year, but all prior attempts eventually died on the vine, and new yearly lows were subsequently made. Only time will tell if this “melt up” has enough legs to eventually generate a new “Buy” signal (section 3).

Economically, things looked pretty dire as Manufactu9irng and Service PMIs, tumbled into contraction, as ZeroHedge reported:

- US Manufacturing 49.9 (contraction), below 51.0 exp and down from 52.0 prior

- US Services 46.6 (contraction), below 49.5 exp and down from 49.3 prior.

Of course, nobody calls it a recession anymore, so we’re in tune with the fact that bad news is good news for the markets, as the eventual “Powell Pivot” hope (from hawkish to dovish) is all that matters. Go figure…

Even higher bond yields could not keep equities down, as the 10-year swung wildly and closed at 4.255%, near its recent highs. The US Dollar meandered aimlessly and so did Gold, with neither having much to show for in the end.

Read More