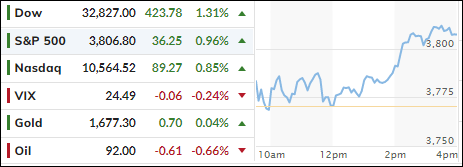

- Moving the markets

The markets shrugged off a supply warning from Apple and extended Friday’s bounce into a week that could present unexpected surprises. The obvious one is tomorrow’s mid-term elections, the outcome of which could very well affect the direction of future spending as well as create a political gridlock.

Any kind of stalemate is viewed as a positive for equities, as no new spending plans would be a good outcome for interest rates. However, Thursday’s CPI report, if it comes in higher than expected, will dash any hopes for the bulls and those betting on a Powell “pause” or “pivot,” with a sell-off being a likely possibility.

Today’s markets started with a sideways meandering of the indexes, which ZeroHedge described like this:

Markets oscillated quietly ahead of the midterms, then at around 1345ET – with absolutely no headline catalyst – a wave of buying suddenly hit every US index, lifting everything comfortably green on the day…

Makes you wonder if the Plunge Protection Team (PPT) had anything got do with it in order to create a positive background, since all other assets dropped on the day. If so, that action was perfectly in sync with an aggressive short squeeze.

Bond yields rallied mid-day, as the 10-year solidified its position above the much-fought over 4% level by closing at 4.22%, which was up by almost 10bps. The US Dollar slumped again, but gold was not able to take advantage of it, and the precious metals went sideways.

Read More