- Moving the markets

Home Depot’s dismal revenue report and bleak outlook sent the markets tumbling in the morning. The company blamed everything from bad weather to weak lumber prices to stingy consumers for its worst miss in two decades. The stock lost 5% of its value before clawing back some ground.

Meanwhile, some mixed signals from the economy added to the confusion. Industrial Production rose by 0.5% in April, beating expectations, but still showing no growth from a year ago. Retail Sales also fell short of the mark, posting their slowest annual increase since the pandemic hit.

And then there’s the looming debt ceiling crisis, which could spell disaster if not resolved soon. Yellen warned last week that failing to raise the limit could trigger an “economic catastrophe” that would hurt confidence, raise costs, and damage the US credit rating.

But neither Biden nor McCarthy seem eager to play nice and reach a deal. They are stuck in a stalemate that resembles previous showdowns; except this time, both parties are too stubborn to budge an inch.

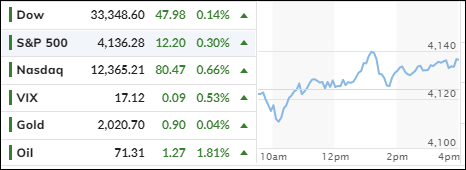

The market didn’t bounce back as expected in the afternoon, and we ended the day with the Nasdaq doing the best and the DJIA doing the worst.

The mixed economic data and the debt ceiling drama dampened the bullish mood from yesterday, with all four global economic surprise indexes dropping together. It’s funny how US Homebuilders are optimistic, while Homebuyers are pessimistic. I wonder who will have the last laugh.

The regional banking sector had a brief short squeeze in the morning, but it didn’t last long and the KRE index turned around and plunged. US Bond yields jumped across the board, with the 2-year staying above 4%.

The higher rates helped the dollar bounce back, but gold took a hit and fell below $2k again.

This makes me wonder: Are the falling economic surprise indexes a hint that the Fed might tighten its policy sooner than later?

Read More