- Moving the markets

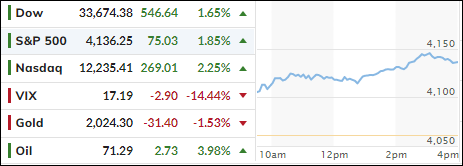

Year-over-year, consumer prices increased by 4.9%, down a tad from the expected 5%, while the month-over-month inflation rate of 0.4% was also in line with projections. While traders interpreted that as good news, market reaction was mixed, with the major indexes advancing only moderately.

When looking under the hood, however, we saw that there is more to this story than just a headline number, namely the fact that inflation continues to outpace Americans’ rising wages—for the 25th straight month, according to ZeroHedge. Ouch!

Still, the softening of the CPI pulled June rate-hike odds down from 20% to less than zero. The markets spiked initially, then dumped into the red but managed to recover into the close. It was a chaotic session with no clear direction and a marginal outcome.

Helping the bulls was a double short squeeze attempt, which in the end did not do much to ignite bullish spirits. The same uncertainty emerged in the Regional Banking circus, where the index (KRE) was pumped and then dumped, which was duplicated in all bank stocks.

Bond yields took a hit, with the 2-year losing its recent gains along with its 4% level. The US Dollar rode its own roller coaster, while Gold followed the overall theme, namely cranking, then tanking but bouncing to a green close. Let’s see what the release of the PPI can do for the markets tomorrow…

Read More