Over the past few days, I have received some emails from long-time readers asking about how they should invest their money now, which mutual funds to buy and how to diversify into which country ETFs.

Over the past few days, I have received some emails from long-time readers asking about how they should invest their money now, which mutual funds to buy and how to diversify into which country ETFs.

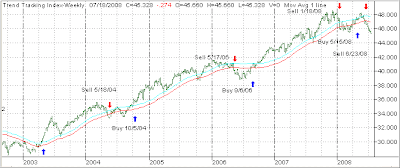

Huh? It appears that these investors are reading my weekly updates and daily blog posts, but are missing the message entirely. At this time, we are in a bear market. I don’t know how to be any clearer about it, but this is not the time to enter the market on the long side; you should be in money market on the sidelines or, if your risk tolerance allows, have some selected short positions.

This bear market has the potential to be far worse than the last one of 2000 – 2002, during which many investors lost some 50% of portfolio value. How do I know? Many people called or emailed and told me so. The main reasons for their losses were simply ignorance as well as bad advice.

Let’s look at the unfortunate realities of what happens to your portfolio and, on a bigger scale, your life, if your investments receive a 50% haircut. You are now put in the unenviable if not impossible position of having to make a 100% return on the balance just to get back to a break even point.

How long will that take? In my view, if you have some cooperating markets (meaning a bull market rally) it could take some 7 years, if you’re lucky. If you were one of those unlucky investors, who lost 50% back by 2002, please write me and tell me if you have gotten back to the even point in the past 6 years. Chances are you didn’t quite make it.

Not only have you lost 50% of your portfolio by being ignorant, or having received bad advice by you-know-who, there is another aspect that is even worse. You have wasted 7 years of your financial life that could have been used to grow your assets rather than you chasing your tail trying to make up losses.

Presumably, you work somewhere from age 20 to age 65, which gives you some 45 years to accumulate your nest egg, which is supposed to carry you through your retirement years. Wasting 7 years of it amounts to surrendering about 15% of the efforts of your financial life. That’s a tragedy!

Come to accept the fact that most investment advice that is being showered on you is simply useless. Sure, the Lazy gone fishing portfolio sounds great, because it appeals to the laziness in all of us. But, it is just as stupid as buy and hold, bullish asset allocation/diversification/re-balancing in a bear market.

I said it before but it’s worth repeating. If an event, such as a bear market, has the potential to wipe out your portfolio, or cut the value down in half, then you should be paying attention to such a possibility. At that point it is absolutely useless, as the last bear market has shown, to be diversified or engage in silly arguments as to whether ETFs are better at weathering the storm than mutual funds.

Many years of capital growth and investing efforts can be wiped out in a hurry leaving you holding the short end of the stick. Wall Street, and its army of commissioned and transaction driven salesmen, will not protect your from nasty downside slides. Their motivation goes beyond your best interest, because their bottom line has priority over yours.

When all is said and done, it is your responsibility to make the right choices. I feel it is mine to try to make sure that the financial sadness and pain of the last bear market won’t affect as many investors as it did in 2000 to 2002.