With the Olympic Games being upon us, I was reminded of a reader’s comment last year. China’s ETF (FXI) had come off its high by 10% causing us to liquidate our positions. This reader wrote in to say that he would hang on to FXI until after the Olympics and then get out.

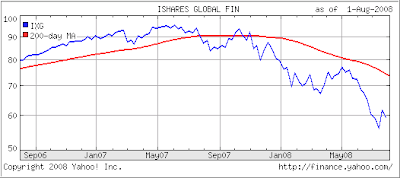

I have heard this argument before that investors tie their financial decision to some future event that most of the time has nothing to do with actual market behavior. Let’s take a look at 2-year chart of FXI:

The decision to hang on proved to be a costly one, since FXI has come off its high by over 40% and has shown tremendous volatility this year. Despite wishful thinking, and the fact that Olympic events at times can light the fire for an economic rebound, this is usually only a short-lived phenomenon and should not be used as an investment opportunity.

Trends don’t lie, they simply state facts as they are right now, and the fact is that FXI is in bear territory. Until it solidly breaks back above its long-term trend line, I would not even consider it.