When you have been dealing with No Load Mutual funds as long as I have, there is bound to be a run-in with a fund manager regarding investment philosophy.

This happened a couple of times over the past 2 years with the end result that my advisory firm was banned from placing trades with that particular fund family — forever, I suppose. Not that I was all broken up over it, but the reasoning left a bad taste in my mouth.

Here’s about how the phone conversation with the fund company (FC) went:

FC: “We noticed that you bought one of our mutual funds and sold it again within 60 days.”

Me: “That’s correct.”

FC: “We don’t allow that. We want advisors to invest with us for the long term. Don’t you do asset allocation?”

Me: “Yes I do. I generally invest for the long term, but the markets pulled back sharply and, to protect my clients’ portfolios from further damage, I moved to cash.”

FC: “We don’t allow that, you’re not supposed to time the market.”

Me: “Let me ask you, what is this fund’s Annual Holdings Turnover?”

FC: “Let’s see, this fund has an annual turnover of 140%.”

Me: “So, that means you pick your stocks and, if they don’t perform, or economic circumstances change, you sell them and buy others. By the end of the year, you have a turnover of some 140%. Is that correct?”

FC: “Yes, that’s right.”

Me: “Then, why don’t you pick the appropriate stocks in the first place? I am sure, that type of frequent in-and-out trading increases costs for your shareholders?”

FC: “Ah…well…you know, that’s not how it works. Things may change, or a stock heads south, and we need to adjust to increase our performance.”

Me: “That makes sense. Then why am I not allowed to do the same thing? If the markets change, I should have the right to liquidate positions, just like you do, to protect my clients’ assets or increase performance. I noticed that, during the last bear market, this fund went down some 40%. If we head in this direction again, shouldn’t my clients’ interests be priority?”

FC: “Hmm, no…yes, but our policy doesn’t allow that. We need to ban you from further trading with our firm.”

Me: “That’s your loss and not mine. Go ahead — ban away.”

That’s the prevailing attitude among most fund families. Their interests rule and yours don’t really matter.

If this type of thinking continues, more and more investors will eventually realize this and move their accounts. Guess where the assets will go?

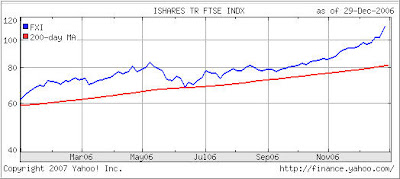

Into ETFs, of course!