Based on reader email, I know that there are many investors out there itching to try to pick a bottom in the severely beaten up financial sector. It’s beyond my understanding why the desire to gamble is so prevalent in that area.

The Big Picture had some enlightening comments on the subject. Here are some excerpts:

Just when you think there is a glimmer of hope that some of these ne’er do well, lying, cheating, sniveling, cowardly bank CEOs might finally be forced to step up to the confessional and tell all, this comes along: FASB Postpones Off-Balance-Sheet Rule for a Year.

Which makes me wonder:How precarious is the financial health of the US banks and brokers that they need yet another year before they can, oh, I don’t know — disclose what they own on their balance sheets?

…

Question: How can anyone value a financial company if they cannot tell what are on their balance sheets?

Answer: You cannot. If you buy a financial under these conditions, you are flying blind

Investment Thesis: Ritholtz Rule #1: Know what you own.

Whoever buys Financials under these circumstances loses the right to whine down the road about companies not forthcoming. If you own them, don’t complain when you get what you deserve.

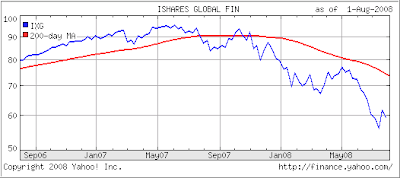

While this article focuses on the fundamentals, the technical aspects are equally disconcerting. The ETF IXG represents the Global Financial sector. Take a look at this 2-year chart:

If you follow trends, there is absolutely no compelling reason to make any commitment to this sector. As I said before, until all skeletons are out of the closet, any rebound will be to short lived, such as happened in May 08, before the bears started feasting on this carcass again.