The hype and angst surrounding the bailout proposal has been enormous, and I have to wonder if much of it was by design in order to shove this idea down peoples’ throats before much analyzing could be done.

The hype and angst surrounding the bailout proposal has been enormous, and I have to wonder if much of it was by design in order to shove this idea down peoples’ throats before much analyzing could be done.

Dr. Housing Bubble featured an excellent article on the subject. Here are some highlights:

As I eagerly await the bread and circus theatre to resume tomorrow, has anyone seen any details on the $700 billion plan? The plan ushered over the weekend by Henry Paulson was an absolute joke and mockery to our economic system. He back peddled and stated that he wanted to keep it as “simple” as possible so discussion in Congress would move much smoother. What in the world is simple about asking that any actions taken by the U.S. Treasury are not reviewable by a court of law? There was a quick firestorm from economist, bloggers, and anyone with an ounce of commonsense how absurd the 3 pages bailout was. Even with the additional modifications to the plan of CEO compensation, equity sharing, and oversight no one is asking the most important question. Why in the hell do you need $700 billion? The mainstream media seems to be neutral about the bailout.

Ben Bernanke, Paulson, and Bush went on their financial fear mongering tour basically saying that if you don’t pass this bailout, the world as you know it will implode on itself. Little do they know that in many cities people are already struggling and have very little to lose if they haven’t lost everything already. This is what the President had to say:

“I’m a strong believer in free enterprise. So my natural instinct is to oppose government intervention. I believe companies that make bad decisions should be allowed to go out of business. Under normal circumstances, I would have followed this course. But these are not normal circumstances. The market is not functioning properly. There’s been a widespread loss of confidence. And major sectors of America’s financial system are at risk of shutting down.

The government’s top economic experts warn that without immediate action by Congress, America could slip into a financial panic, and a distressing scenario would unfold:

More banks could fail, including some in your community. The stock market would drop even more, which would reduce the value of your retirement account. The value of your home could plummet. Foreclosures would rise dramatically. And if you own a business or a farm, you would find it harder and more expensive to get credit. More businesses would close their doors, and millions of Americans could lose their jobs. Even if you have good credit history, it would be more difficult for you to get the loans you need to buy a car or send your children to college. And ultimately, our country could experience a long and painful recession.”

Holy crap! If you put it that way, why don’t we raise the amount and give Paulson $10 trillion? God forbid you take my credit cards away. You mean we are going to lose additional jobs on top of the 605,000 that have already been lost this year?

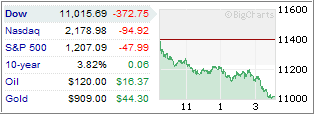

So this is something that is already happening. Now we get the ultimate fear mongering of seeing your stocks decline. Some Americans are living paycheck to paycheck let alone investing. Let us see the raw numbers here. How many Americans own stocks?

57 million households own stocks directly or through mutual funds. Given that there are 105,480,101 or so households, that means 54% of people will be impacted by a decline in stock values directly in their portfolio. What this also means is that 46% of Americans do not own any stocks. But how much money do American’s really have saved in retirement accounts? Given that the median household income for U.S. households is $46,326, let us run these quick numbers:

401(k) Median Amount

20 year olds

(Salary Range)$40,000 – $60,000 = 401(k) Median Amount $16,393

30 year olds

$40,000 – $60,000 = $38,693

40 year olds

$40,000 – $60,000 = $78,834

50 year olds

$40,000 – $60,000 = $99,932

60 year olds

$40,000 – $60,000 = $97,588

Sources: Employee Benefit Research Institute, Investment Company Institute

So let us assume that the market goes bonkers and it declines by 30 percent. How much do 20 to 29 year olds lose? $4,917. What about those in their 30s? $11,607. How about the hypothetical 40s family? $23,650. A 50s or 60s family looks to lose approximately $29,900. Is there any wonder why there is a big generational gap going on here? That is why the next big issue which in fact is bigger than this bailout is the entitlement programs that will be coming down the pipeline for the baby boomers. The median 20 – 39 year old household has probably lost more simply by inflation and stagnant wages. Certainly the amount of money being thrown toward Paulson and Bernanke is nothing to justify even a horrific 30% drop. The numbers simply do not pan out. In addition, if you retire say at 62 with $97,000 and live until 75, divided over 13 years we are talking about living on $7,461 a year plus Social Security. Try managing that one.

Again, those that stand to benefit the most are in the top 5% of this country. Why do you think there has been wide opposition to this bailout? Take a look at this L.A. Times and Bloomberg poll:

“(L.A. Times) Americans oppose government rescues of ailing financial companies by a decisive margin, and blame Wall Street and President George. W. Bush for the credit crisis.

By a margin of 55 percent to 31 percent, Americans say it’s not the government’s responsibility to bail out private companies with taxpayer dollars, even if their collapse could damage the economy, according to the latest Bloomberg/Los Angeles Times poll.”

As it turns out, a large number of Americans actually have the guts to stand up for what is right. Plus, they realize that the economic plan will do very little to benefit them. Take a look at the above numbers. Approximately 30% of Americans own their homes free and clear. Many of these people do not want to bail out banks that made absurd idiotic loans while they were being prudent. In addition, many other Americans are making their mortgage payments on a timely manner. Do you think they are going to appreciate dolling out assistance to lenders that gambled their future away? Of course not.

The problem with the $700 billion price tag is no one is bothering to explain why they need $700 billion. Why not $200 billion like the Fannie Mae and Freddie Mac bailout? The only reason we get is “it needs to be sizable enough to impact the markets.” Bull. After all, if this program as I read it is setup to continually recycle loans in a garbage in garbage out model, having a $200 billion pool should be enough to take in enough crap mortgages at a major discount, throw them back on the market, and repeat the process over and over until the crisis is over. Wouldn’t that make the most sense?

But of course Ben Benanke keeps using the Roto Rooter argument that the credit markets are clogged. Good! That is the damn reason we got into this mess to begin with. The fact that the President tried to instill fear about having our credit cards taken away is a blessing in disguise. People shouldn’t be spending money they don’t have. People shouldn’t have bought homes they could never afford. Forget the auto loan. Time to clean up the balance sheet of your house. And the banks and Wall Street? If the buyers were the drug users Wall Street and the lenders were the drug pushers. Let them implode. This “I’m for the free enterprise except for the largest bailout known to mankind” is absurd.

If that is the case, I would feel more comfortable pushing through healthcare for all and investing in our crumbling infrastructure. At least we’ll get something for the price tag there. Instead we are going to use the money to bailout banks? Talk about massive hypocrisy. Let us run through the doomsday scenario since many don’t have the desire to look at this.

(a) No bailout. People and financial markets initially panic. Weak institutions will no longer be able to hide the sausage and will be exposed and will collapse. In fact, a few people have estimated that nearly half of the 8,429 commercial will fail.

(b) Systematic failure of these toxic institutions. They fail and their poor risk management brings them down. They knew the risk. Making $500,000 loans on 500 square foot boxes and pocketing beacoup money is gambling. Hope you enjoyed your reckless spending.

(c) Banks that do remain, will lend but to those that meet certain standards. What is so bad about that? What we are basically being told right now is that we have to continue believing that the Great Wizard of Oz really isn’t some shady banker behind the cape. In fact, they want us to continue this model of giving money to people that don’t qualify. That is simply unsustainable. But guess what? The United States itself is now becoming the debt addicted borrower on the world stage.

(d) Standards get better and we move our economy away from this model of flipping houses to one another and obsessing with remodeling our homes as a method of economic stability. Are we a world power because we watch HGTV and have an obsession with granite countertops? Of course not. The jobs of the future are in biotech, engineering, and IT and we are going to drop $700 billion in propping up a system that rewards flipping and rehabbing homes? You know what that will do for our future economy? It is going to saddle us with so much debt, we’ll be unable to focus on anything else. Please refer to Japan to see how well it works when you zombify your banking industry after a housing bubble.

(e) The correction happens and we move on. New industries develop and new careers will come forward in time. This happens in any business cycle. When will this happen? It is hard to say but once we get back to more prudent standards we can get our country back on the right course.

So essentially that is how things will play out if there is no bailout. But say there is a bailout. What changes from above? My prediction is this is what will happen:

(a) Bailout passes. Initial euphoria on the markets which will give way to reality since Main Street has horrific balance sheets. The party will wear off quickly. We are still at record high foreclosures and nothing will stop this. Why? Because much of our economy was dependent on an incestuous relationship of, “I sell you home. I get commission check. I buy home with check. I sell other home. Use check to remodel and pay construction workers…etc etc.” It all depended on people buying and selling homes at a hyper accelerated pace. That will not continue.

(b) Once Main Street realizes that they were shafted, there will be an uproar but what will they do? Will they protest? Will they take to the streets? Who really knows. The deal at that point will turn into buyers remorse. After all, the government buying the loan doesn’t remove the fact that the loan is still bad. Let us run a scenario:

-The government buys a loan from X bank. X bank claims the mortgage is worth $400,000. The government offers a minor discount of 10% and takes the loan. They now have a $370,000 loan. The borrower has received zero savings. The government can try passing the savings to the borrower but most likely they will still not be able to make the payment. What if they can only make the payment on a note of say $200,000. Will the government modify the loan to that level? If that is the case and the root cause is helping home owners, why not let judges use cram downs and force lenders to modify loans as such with equity kick backs to lenders. That is, if the folks sell the home in a few years for a profit that cash goes back to X bank. Why don’t they go for this? Because it exposes the drug dealer (Wall Street and banks) and drug abusers (home borrowers who want a free lunch). This would make the most sense.

-The government will most likely have a foreclosure on their hand. So now what? Are they going to try to sell the home in this current market with already tons of inventory? They are going to get screwed 2 times here. First, they’ll get shafted from lenders since I doubt they’ll be offering 30 to 40 cents on the dollar which they should. So they’ll over pay once here. Many of these borrowers will default. So now, you have a home and you need to place the home on the market. Guess what, the market sucks. So now, you have to drop your price (another price hit) and accept what the market will offer you.

…

There is a silver lining. The majority of Americans are seeing through this sham. Keep calling and writing your representatives since at least it stalled it long enough to keep comrade Paulson from turning this country into a crony capitalistic mortgage swap meet.

I could not have said it any better. Based on feedback from my readership of 18,000, I can attest to the fact that many are calling their representatives and asking for this bailout to be voted against.

These unique current times may very well go down in history as a fight against the power grab by a few and will be examined from all perspectives for years to come.

If you want to make a difference and contact your representatives, I suggest you read Mish’s article “Take Back America” at Global Economic Analysis, where he has listed fax and phone numbers as well as reference links of senators/congressmen to contact.

OK, I have to admit it, the following is not my idea, but it was sent to me by reader John, and I believe it’s currently circulating on the internet.

OK, I have to admit it, the following is not my idea, but it was sent to me by reader John, and I believe it’s currently circulating on the internet.