Hat tip to Mish at Global Economics for this great rant about bailing out the big boys on Wall Street:

[youtube=http://www.youtube.com/watch?v=mbD62gNi9WE]Power Grab

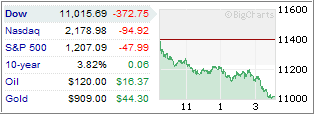

The markets whipsawed Tuesday and ended sharply lower because of the bailout package not racing through congress as many had hoped for. Good thing, because some of the provisions are questionable and downright alarming.

The markets whipsawed Tuesday and ended sharply lower because of the bailout package not racing through congress as many had hoped for. Good thing, because some of the provisions are questionable and downright alarming.

Can you spell power hungry? Then read what now have become the most feared 32 words of the bailout proposal submitted by Treasury Secretary Paulson:

“Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.”

This may be one of the reasons comrade Paulson wants to shove this package down everyone’s throat before there is a realization of what that absolute power really means. To give any appointed individual the power to do what he pleases with $700 billion seems simply outrageous to me.

I like to hear your viewpoint. Simply click on the “comment” label below and type in your response.

Too Negative?

The markets tanked again yesterday as much uncertainty about the proposed government bailout package prevented traders from chanting that happy days are here again. The bears ruled, and I expect this volatility to continue for quite some time.

The markets tanked again yesterday as much uncertainty about the proposed government bailout package prevented traders from chanting that happy days are here again. The bears ruled, and I expect this volatility to continue for quite some time.

With the unique events of the past few weeks, I have attempted to write about as well as reference articles of interest describing the once-in-a-lifetime Wall Street meltdown and bailouts in a realistic way without sugar coating.

I have had an email exchange with reader Doug, who had this to say:

Please don’t take this wrong, but many people (myself included) heed your words closely. Your negative comments regarding the “bailout” could be damaging to their morale.

I’m having enough trouble stomaching this bailout, but keep on reminding myself of the consequences of our leaders’ doing nothing in this financial crisis.

I try to realistic and brutally honest in my assessment and references. I don’t intentionally dwell on negatives although it seems that some readers have problems with my realistic viewpoint.

The financial markets are facing a situation unlike anything ever seen before, so there are no historical precedents, and the only way for me to deal with it is calling it the way I see it. If that offends some, tough!

This blog is not about political correctness, sugar coating events or worrying about somebody’s morale; it’s about assessing where we are and finding the best way for our portfolios to survive so that we are in a position to take advantage of opportunities down the road.

The Bailout Culture Turns 10

In light of the government bailout of failed institutions, it is only fitting that these current efforts are happening around the 10-year anniversary of the rescue of Long Term Capital Management (LTCM), which I detailed in a book review last year titled “When Genius Failed.”

In light of the government bailout of failed institutions, it is only fitting that these current efforts are happening around the 10-year anniversary of the rescue of Long Term Capital Management (LTCM), which I detailed in a book review last year titled “When Genius Failed.”

MarketWatch had a follow up story to that historic bailout. Here are some snippets:

In less than two weeks, Wall Street will pass a milestone that on the surface probably doesn’t seem to have much relevance today: the 10th anniversary of the bailout of Long-Term Capital Management.

But the LTCM near-collapse and rescue set in motion Wall Street’s unchecked rush to risk during the decade by signaling to the market that the government would ultimately come to the rescue.

Wall Street is a kids’ game, so let’s refresh our memories. Everyone born before 1990 can skip ahead a couple of paragraphs.

LTCM was a hedge fund run by former Salomon Brothers bond whiz John Meriwether and a half dozen other traders. They raised $1.01 billion in 1994 and ended up with derivative positions of about $1.25 trillion, built on leverage, when the bets turned bad and lenders started asking for their money in the summer of 1998.

LTCM was strapped for cash. So, rather than unwind its positions and send the market into turmoil, the Federal Reserve Board of New York organized a $3.75 billion bailout paid for by Wall Street banks. The cash allowed LTCM to meet its obligations as it unwound its trades.

Maybe it’s because the numbers seem small by today’s standards, but LTCM caused a lot of anxiety at the time. The day after the bailout was announced, the Dow Jones Industrial Average fell 2%, mostly because investors feared the banks would lose their investment. The fall was followed by another 3% drop two trading days later when investors worried the Fed didn’t do enough.

Flash forward to 2008. On Monday the government pledged $200 billion to prop up Fannie/Freddie, two companies whose main investments were considered among the safest on Wall Street: American home mortgages.

The Treasury Department’s move followed one by the Fed in March. In a desperate attempt to help Bear Stearns Cos. avoid bankruptcy, New York Fed Chairman Timothy Geithner brokered a buyout with J.P. Morgan Chase & Co. The Fed backed $30 billion in assets with taxpayer money as part of the deal.

…

Since the start of the year, 11 U.S. commercial banks have failed. In July, regulators shut down IndyMac Bank, a move that will cost the Federal Deposit Insurance Corp. — and, by extension, anyone who keeps his or her money in a bank — $10 billion.

That’s reasonable, at least compared to what the auto industry wants: a $50 billion bailout in the form of loans to help the companies retool lines and become competitive. The airlines will be next, of course.

You can’t blame Rick Wagoner at General Motors for passing the hat to Uncle Sam. These CEOs have seen what a little government intervention can do, whether it be banning naked short selling for a few bank stocks or propping up the entire mortgage banking industry with billions in backing.

The taboo against bailouts has been broken. Now the problem is that everyone is rushing the government at the same time. Wall Street firms ran up risk for a decade after the LTCM bailout precisely because there was a bailout.

The unwritten message, what the bankers call moral hazard, was simple: come a crisis, the government will do everything it can to avoid a collapse. The leverage at Wall Street banks remains high. At Lehman, the ratio of debt to equity is 10.6, and this is after the bank spent nine months reducing its leverage. At the time of the LTCM meltdown the ratio at Lehman was 6.2.

Rising leverage is a familiar story across Wall Street. That these firms are all imploding at the same time should not come as any surprise to the government. Brokerages, banks, mortgage banks, airlines and automakers at the door in a classic run on the bank, but this time it’s the Central Bank.

The good news is that there was a happy ending to the LTCM scandal. The bailout banks eventually made a profit on the investment by the time the fund actually was closed in 1994.

Do you think taxpayers will have the same success when we look back on this in 10 years? Even Meriwether and his LTCM buddies could get that one right.

The last paragraph sums it up. LTCM was one entity to deal with. Now we have entire industries in dire straits and, to my way of thinking, this bailout will not end up making a profit no matter how long you wait. It’s like poring money into a bottomless sink hole with the taxpayers getting stuck footing the bill.

Sunday Musings: A New World Order

The WSJ featured a niece piece titled “One Week Later, a New World Order,” which reflected on the amazing events of this past week. In case you missed some of the action, here are some excerpts:

The WSJ featured a niece piece titled “One Week Later, a New World Order,” which reflected on the amazing events of this past week. In case you missed some of the action, here are some excerpts:

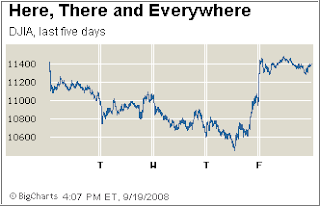

Years from now, number-crunchers looking at weekly changes in the Dow Jones Industrial Average will look at the week ending Sept. 19, 2008, and see that the Dow managed a paltry 33-point decline for this most recent five-day period.

It’s a 33-point move by way of a 1000-point swing. The exhausting roller-coaster of the last five days would have traders happy to see the weekend arrive were it not for the anticipation of more activity from federal regulators and Wall Street bankers over the weekend. It will be difficult to surpass the sinking feeling investors had this past Monday, however, when several large financial companies were teetering on the brink all at once.

Just five days and a bankruptcy, a government takeover and a shotgun merger later, the American financial system has been completely reordered, and more changes in the regulatory framework and on Wall Street are likely to come in the next few years.

“I’ve been trading 23 years, and I can finally say this has eclipsed what I saw the week before and the day of the 1987 market crash,” says Tom Alexander, president of Alexander Trading. “I didn’t think I’d ever say that. So many things have changed so quickly, maybe even more so than 1987.”

The two-day, 800-point rally on the Dow industrials has most assuredly left traders with a sense of renewal after the crushing losses earlier in the week, but the cost is likely to be great. A temporary ban on short-selling of 799 financial issues goosed that sector, which led the way, but left Mr. Alexander wary of what’s next to come, as he judges most of this rally to be short-covering.

The last few weeks have progressed with an air of foreboding. Large fund managers weeks ago were warning that American International Group Inc. needed $15 billion to $25 billion in capital, with one saying that “they’re the one that scares me the most.” In the end, they’re the one that received the most in the way of government help — but at the highest cost, interest rates north of 11% as it currently stands.

Through the 13 months of this winding credit crisis, the prevailing hope among investors, banks and traders was that the next development, be it major write-downs from an investment bank, unloading of terrible assets, another interest-rate cut, or the announcement of a new lending facility, would be the definitive one that would “get us past all of this.” It was the slump in subprime, the Bear Stearns fiasco, and then the TSLF, and then the Fannie/Freddie bailout.

This past week that scenario played out at the speed of light, with traders digesting the news of the Lehman Brothers bankruptcy and responding not with relief, but by moving on to the AIG feeding frenzy.

The financial death spiral produced memorable hair-trigger decisions that may, in hindsight (following the Treasury’s “enough is enough” moment Thursday afternoon), look hasty, such as John Thain’s decision to partner the vaunted Merrill Lynch firm with Bank of America.

That short-selling ban may have been enough to save Merrill, but as the saying goes, you can’t unring that bell. Then again, what’s happened at the end of this week may only be a postponement of the execution, with Hank Paulson’s hand on the lever, deciding the fate of money-market fundholders, short-sellers, and the nation’s largest financial institutions.

“It creates stability, but long-term, the fundamentals remain the same,” says Keith Springer, president of Capital Financial Advisory Services in Sacramento, Calif.

Some of that uncertainty will be resolved this weekend with the potential formation of some kind of “bad bank” structure that would buy up the underperforming, hard-to-sell assets sucking all the air out of Wall Street’s firms. It may prove ephemeral, because it will force those firms to sell these assets at bargain-basement prices to the U.S. Garbage Barge Trust, or whatever it will be named, and already there is talk that some are unhappy with that.

…

In the annals of history last week will be remembered as the implosion. But the market heads into next week treading on a landscape where short-selling is prohibited, the government is engineering some kind of Golem-like structure to cleanse balance sheets, and investors cannot be sure if the two-day rally was for real or a mirage.

Consider it sort of a financial demilitarized zone, where little remains, save perhaps for overturned tractor-trailers with piles of nickels lying about.

Short-term stability has been achieved but at tremendous cost. Over the next few weeks and months we will see whether applying a quick-fix solution has any merit and affects staying power as far as the financial markets is concerned.

Postponing A Crash

There have been so many stories and blog posts about the events of this past week that it’s hard to keep up. Mish at Global Economic Trends made several references, but here is one short synopsis that sums it up:

There have been so many stories and blog posts about the events of this past week that it’s hard to keep up. Mish at Global Economic Trends made several references, but here is one short synopsis that sums it up:

This is a historic day for financial markets as the free market system has effectively been put on hold. The implications are profound, not only for the option markets and hedge fund industry, but for the integrity of the system itself. While something needed to be done to avert a market crash, this was a last gasp act of desperation. In many ways, it validates the view that the market would have crashed.

The SKF (proshares ultrashort financials) has been halted down 22%. It’ll be real interesting to see how they’re gonna mop that one up. They can’t simply pretend it’s not there and make it disappear. Oh wait, they can. I forgot–they can do whatever they want.

Do I sound bitter? It’s not a function of losing money. I respected the magic hat into expiration and discipline saved me. I am profoundly saddened with what we are seeing, however, to a degree that it’s probably a good idea for me to hold my tongue until I have an opportunity to digest and synthesize these historic events.

Now that it has become clear the U.S Treasury, the Fed and the SEC are in the business of manipulating markets by prohibiting short selling and propping up companies that should have failed, you know that the free market system as we have known it has been altered forever.

While a crash has been postponed, I am not sure yet what the implications will be, but as more becomes known, I will share my viewpoints with you. In regards to market direction, you don’t want to be invested in anything. This week has proven that you could have gotten your head handed to you on a silver platter no matter if you were long or short.