A few weeks ago, I mentioned in a conversation with a client that I would not be surprised to wake up one morning and find the Dow down some 500 points. Well, it did not start out that way yesterday, but we ended up with a drop of 504 points.

A few weeks ago, I mentioned in a conversation with a client that I would not be surprised to wake up one morning and find the Dow down some 500 points. Well, it did not start out that way yesterday, but we ended up with a drop of 504 points.

Of course, the news all weekend was focused on Lehman as to whether they would find a suitor or not. Other hot topics were Merrill Lynch and the sudden drop in stock price of AIG. As Lehman headed for bankruptcy, the futures pointed to a sharply lower opening.

To me, it’s hard to understand how a company like Lehman, which was founded 158 years ago, could be destroyed in less than 12 months. It was nothing but stupidity, ignorance and sheer greed that contributed to its speedy demise.

The Lehman meltdown sparked a harsh reaction from one floor trader in Chicago:

“These are supposedly sophisticated suits — there isn’t a commodity trader on the floor who would do what they did. Every trader knows it isn’t what you make, it’s what you don’t lose,” said Lenny Pomerantz, a 30-year veteran of the Chicago Mercantile Exchange and Board of Trade.

“I am appalled that major financial institutions that are theoretically advising other investors and institutions on what to do to be financially stable would put themselves at such enormous risk by leveraging anywhere from 30 to 35 times. They went out on a limb without even knowing it was a twig,” said Pomerantz.

Of course, the big unanswered question remains as to how the rest of the industry and trading partners will be affected when somebody like Lehman has $613 billion in debt and no market capitalization.

However, since we don’t control the clowns on Wall Street, we will continue to focus on where the trends are. They appear to be the only thing that is “real” in this crazy environment. Trying to make any fundamental assessments is simply an exercise in futility.

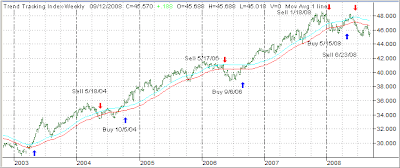

No question, yesterday we slipped deeper into bear market territory, and our Trend Tracking Indexes (TTIs) confirm this direction:

Domestic TTI: -3.33%

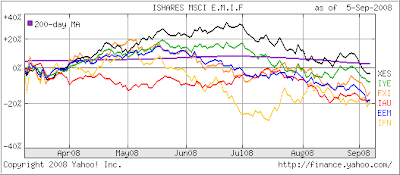

International TTI: -12.01%

The biggest threat to further downturns will be the outcome of insurer AIG. If their credit rating gets reduced, the fallout and impact on the market could be so severe and far reaching, that it would make yesterday’s drop like a walk in the park.

Sitting on the sidelines in the safety of our money market funds never felt so good.