- Moving the markets

An early rally hit the skids with the major indexes giving back all their substantial initial gains. The exception was the Nasdaq, which managed to end up fractionally above its unchanged line.

Contributing to this sudden transformation in sentiment were the same old standbys, as Covid variants and slowing economic growth overwhelmed strong earnings reports.

The dead giveaway, that the economy is not all it can be, became obvious as bond yields tumbled just as they did last week when the same issues surfaced. The 10-year crashed to the 1.15% level before rebounding into the close.

The cause of this sudden change of heart, was the Manufacturing ISM survey, the index of which fell to its lowest in 2021, with the “soft” data now starting to catch “down” to hard data’s reality, as ZeroHedge put it.

That created havoc in the bond and stock markets, the latter of which were spooked some more after the Fed’s Waller warned in the last hour that good jobs data reports could move the timetable for the Fed by possibly “tapering early and fast.” To traders that means the punchbowl of easy money could be endangered, so stocks dumped off their early highs.

In the end, it was only this morning’s unrealized gains that were given back, as the major indexes barely crossed their unchanged lines into the red. Whether this is a harbinger of things to come remains to be seen.

The US Dollar index went the other way by selling off early on but rallying back into the close. Despite this chaotic back and forth, gold managed to come back from an early pullback and ended unchanged.

To make it easier for you to follow my various blog posts, you can view the current schedule here.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

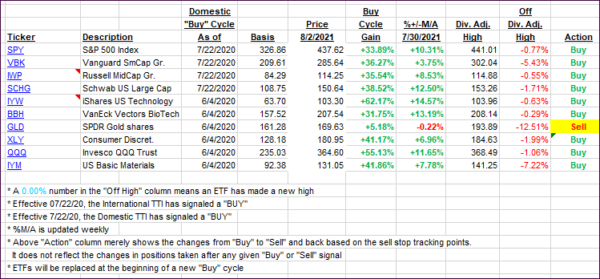

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs showed a mixed picture with International gaining in the face of the domestic sell-off.

This is how we closed 08/02/2021:

Domestic TTI: +10.14% above its M/A (prior close +10.30%)—Buy signal effective 07/22/2020.

International TTI: +6.44% above its M/A (prior close +6.08%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investmentrecommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli