- Moving the markets

After yesterday’s ramp, you could have expected some sort of pullback in the markets, but the rally continued unabated with some sell off into close, however, green numbers prevailed. Leading the charge was the Nasdaq with a gain of +0.52%.

Helping the major indexes to maintain upward momentum was news that US regulators granted full approval for the Pfizer vaccine, causing traders to presume that the latest Covid flare up has peaked.

Overall, it was a fairly quiet day with the focus being on the upcoming Jackson Hole symposium later this week. Again, the open-ended question is whether the bankers will disclose more details about their intended plans to taper stimulus—or not.

The summit will be on a virtual basis and held on Thursday with Fed head Powell giving a speech on Friday. Opined one analyst: “It will probably be a slow taper with no commitments over interest hikes.”

Business Sentiment soured, confirming the recent trend of “soft” survey data dumping back to the reality of “hard” data, as Zero Hedge saw it, with Bloomberg graphing the trend here.

The short squeeze of the past few days persisted with the index now having bounced off the bottom by some 9%. The 10-year bond yield headed north hitting overhead resistance, while the US Dollar accelerated its southerly path of the past two days.

The leap in yields neutralized gold, which bounced around its unchanged line and ended the session down a tad, but its chart pattern indicates that a breakout, either up or down, will be a distinct possibility in the near future.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

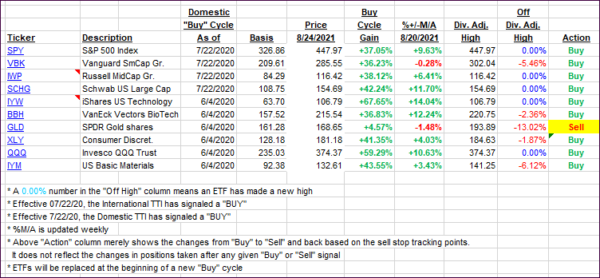

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs inched higher as the broad base rally continued.

This is how we closed 08/24/2021:

Domestic TTI: +9.81% above its M/A (prior close +9.36%)—Buy signal effective 07/22/2020.

International TTI: +5.64% above its M/A (prior close +4.97%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli