- Moving the markets

After two days of aimless sideways meandering, the markets broke out to the upside although in moderate fashion. Nevertheless, it was enough of a spurt for the S&P 500 to score a new record high, while the index stopped just short of breaking through the 4,100 level.

“Growth” outperformed “value” by a wide margin leaving some analysts wondering if the value surge has come to an end in favor of growth. However, these swings can reverse at any time, and it’s wise to be exposed to both.

Initial Jobless Claims disappointed again with 744k Americans filing for new unemployment benefits for the first time, far worse than the expected 694k. When looking at the bigger picture, it’s revealed that over 18 million Americans are still on government benefits, despite broad re-openings across the country.

Still, optimism runs rampant that the next few months will see huge job gains with some forecasting that employment will return to pre-pandemic levels by the end of the year. I am not sure if that view is simply designed to keep the market pumped up, because that does not seem realistic to me, as the recovery is spotty or uneven at best.

The US Dollar resumed its downward trend, while 10-year bond yields slipped again to reach 1.65%. This combo helped the gold ETF GLD to bounce nicely by gaining +1.06%, on par with the Nasdaq advance.

As we go forward, financial support via fiscal policy, and continued asset purchases by the Fed, will be the foundation for further advances.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

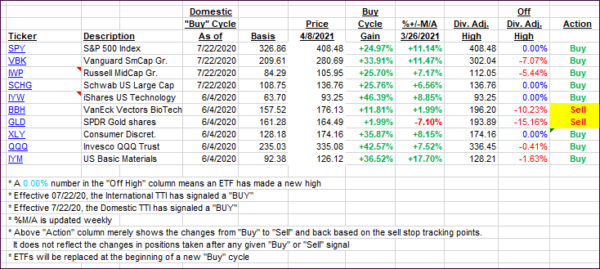

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs inched higher with the indexes breaking out of a sideways pattern.

This is how we closed 04/08/2021:

Domestic TTI: +20.90% above its M/A (prior close +20.68%)—Buy signal effective 07/22/2020.

International TTI: +17.91% above its M/A (prior close +17.81%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli