- Moving the markets

It was another sloppy and choppy session with the Dow being the leader, while the Nasdaq was unable to climb out of an early hole, but it trimmed some of its initial losses. The S&P struggled all day but closed in the green, while gold came off its early highs but hung on to some modest gains.

Commented MarketWatch:

Investors monitored signs that a long-awaited rotation on Wall Street into more economically sensitive cyclical stocks could be brewing, but at the expense of their highflying counterparts.

However, more attention was given to Trump’s signing of executive orders extending some of the coronavirus relief benefits. Maybe that will push the warring parties back to the negotiating table for a reasonable solution to the current crisis, while abandoning irrelevant pork that has nothing to do with the Covid-19 disaster.

While the torrid advances of gold and silver have slowed a bit during the past couple of trading days, the bull run is far from being over.

Analyst Graham Summers noted in his latest mailing:

The reality is that the only way the Fed could stop gold’s rise would be to begin tightening monetary policy via interest rate hikes and reducing its Quantitative Easing (QE) program.

The Fed cannot do this without triggering a market crash. As I’ve noted on these pages before, the ONLY thing that stopped the March meltdown was the Fed going nuclear with monetary easing, providing over $3 trillion in liquidity.

Indeed, today the Fed continues to spend over $125 BILLION per month in QE a full three months AFTER the crisis. And the Fed has stated it will continue to do this until there is a full recovery (the Fed believes this will come at the end of 2021).

Put another way, the Fed is trapped. It can either tighten monetary policy and crash the markets, or it can let inflation run wild and gold will go parabolic.

In the meantime, the saber rattling continued between the US and China with new sanctions against politicians and organizations being considered. Then we learned that Chinese jet fighters crossed the midline of the Taiwan Strait, just as a senior US official was visiting the island.

All these developments increase uncertainties, which to me means gold should be an important component in anyone’s portfolio.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

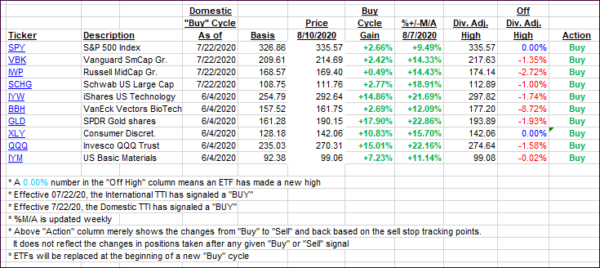

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs surged with especially the Domestic one taking a jump deeper into bullish territory, despite only the Dow showing superior performance.

This is how we closed 08/10/2020:

Domestic TTI: +7.14% above its M/A (prior close +6.03%)—Buy signal effective 07/22/2020

International TTI: +3.42% above its M/A (prior close +2.83%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli