- Moving the markets

The futures markets kept bullish momentum alive based on news that a live-saving steroid, dexamethasone, was found to cut the risk of coronavirus death by 35% for patients on ventilators, and 20% for those on supplemental oxygen without intubation.

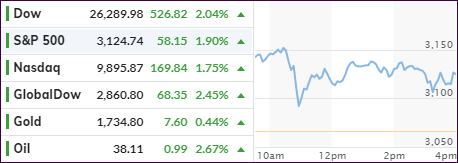

How this will turn out is everyone’s guess at this time, but it was enough to ramp the markets higher. This momentum put a fire under the Dow, as the regular session got underway, with the index sporting a 700-point gain after the opening bell.

Giving an assist was Fed chair Powell’s testimony before Congress and his suggestion that more fiscal stimulus might be needed before the American economy can make a full recovery from the coronavirus pandemic.

With the Fed now having admitted to buying individual corporate bonds as well, stocks and equity ETFs are on deck and will most likely come into play after another 20% market drop.

Added Global Market Monitor:

The United States is on the fast track to a Japanese style zombie economy, where the Nikkei 225 is still 45 percent below its December 1989 high, even after massive fiscal stimulus and quantitative easing, which includes direct equity purchases by the central bank. Japan is also a net saver and the U.S. is not.

Technical analyst Sven Henrick saw it this way:

But it’s not just the Fed. Yesterday’s announcement was apparently not enough as the Trump administration suddenly tossed a trillion-dollar infrastructure plan soundbite on top of the liquidity fire. Also, on the heels of a 10% correction. How convenient. Whether that plan ultimately materializes or not is beside the point, futures reacted and squeezed vertically even higher. What a circus. Not a stable market and my mantra of the extremes getting ever more extremes continues to hold true.

In the olden days future growth came about because the system was allowed to cleanse itself and new business models sprung to fruition from the ashes. Inefficient businesses went bust; new businesses were formed. Corporate debt was reduced. That’s called a cleansing and new innovation.

Be that as it may, the markets rallied strongly also supported by soaring retail sales in May after a disaster number the month prior.

Thanks to today’s levitation, our Domestic TTI (section 3) rallied back above its long-term trend line thereby confirming our bullish position—at least for the time being. We are seeing market absurdity, and I am sure that increased volatility and sudden reversals are here to stay.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

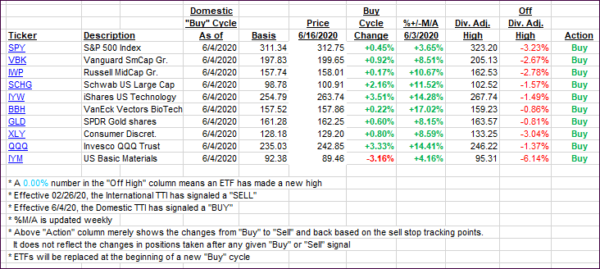

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which was effective 6/4/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Domestic TTI finally broke back above its long-term trend line after having spent three trading sessions below it thereby confirming our bullish stance. Things can change in a hurry though, as it appears that the casino mentality on Wall Street is bound to continue due to the never-ending market manipulation.

This is how we closed 06/16/2020:

Domestic TTI: +1.10% above its M/A (prior close -0.96%)—Buy signal effective 06/04/2020

International TTI: -2.77% below its M/A (prior close -4.96%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli