ETF Tracker StatSheet

You can view the latest version here.

WALKING BACK THE TALK

- Moving the markets

Yesterday’s extremely dovish words by the Fed’s mouthpiece Williams seem to have struck some raw nerves, as the Fed tried to walk back the “communications debacle.” It was like putting the toothpaste back in the tube, as William’s viewpoint raised market expectations to an upcoming 0.5% rate cut as opposed to a potential 0.25% reduction.

This kind of head fake caused the NY Fed to subsequently release a statement stating that “President William’s speech on Thursday afternoon was not intended to send a signal that the Fed might make a large interest rate cut but rather is was ‘an academic speech on 20 years of research.’”

Of course, the markets reacted positively yesterday, but today’s reality check pulled the major indexes off their early session highs and sent them south with all three of them not only closing in the red but also at the lows for the day. Summing it up, the Fed better deliver a 0.25% rate cut, or equities will head south in a big way.

Tensions in the Middle East ratcheted up a notch, as a drone was downed, and an oil tanker was hijacked, which had traders is a sour mood adding to the overall negativity in the marketplace.

While bond yields tumbled for the week, they did spike today, thereby negatively affecting bond prices, as well as low volatility ETFs, such as SPLV.

Benefiting from all this turmoil was the long-forgotten metal, namely silver. It soared over 6% for the week and is back above $16. This was silver’s biggest weekly gain since July 2016, and it improved its ratio with gold considerably, as the chart shows.

While all eyes are on the Fed, they will not issue their verdict on interest rates until July 31, which means we have another 1.5 weeks to put up with the seemingly endless jawboning as to why they should or should not pull the trigger.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

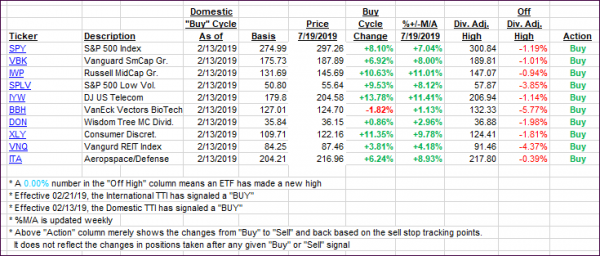

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as too much negativity favored the bears.

Here’s how we closed 07/19/2019:

Domestic TTI: +6.74% above its M/A (last close +7.44%)—Buy signal effective 02/13/2019

International TTI: +4.24% above its M/A (last close +4.52%)—Buy signal effective 06/19/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli