1. Moving The Markets

Stocks broke their two-day losing streak today as investors became encouraged by better-than-expected earnings reports from Alcoa (AA). All of the major indexes gained. In other earnings news, shares of The Container Store (TCS) dropped 9% after the specialty retailer reported earnings below expectations and said it was experiencing a retail “funk.”

The Fed was back in the headlines today as they announced that they are leaning toward ending the central bank’s monthly bond-buying stimulus in October. Citing an improving labor market and economy, Fed policymakers have tapered their government bond purchases in $10 billion increments at each meeting since December, cutting them to $35 billion a month from $85 billion.

Economists have debated whether the Fed would continue to trim the purchases by $10 billion at the October meeting — leaving it buying $5 billion in bonds until the December meeting — or cut the purchases by $15 billion to zero in October.

You may remember that a couple of days ago I noted that airlines had taken a dive due to decreased international traveler flow to Latin America during the World Cup season. Well, airlines bounced back today. Shares of American Airlines Group Inc. (AAL) and Southwest Airlines Co. (LUV) jumped 4% and nearly 2% respectively on positive forecasts for the second quarter. The companies reported increased demand for air travel in the coming summer months and abated concerns about the health of the sector’s profit margins.

Our 10 ETFs in the Spotlight recovered with one of them again managing to make a new high for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

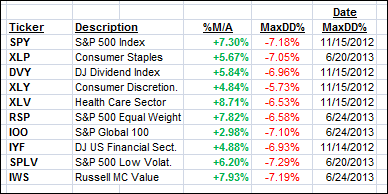

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

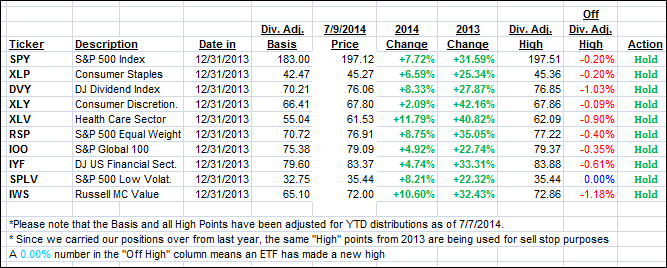

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) reversed and headed deeper into bullish territory:

Domestic TTI: +3.31% (last close +3.11%)

International TTI: +3.51% (last close +3.33%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli