1. Moving The Markets

Markets dropped today amidst questions over the health of a large Portuguese bank namely Banco Espirito Santo. Concerns over a delayed payment caused a stock sell-off in Europe and the angst spread to Wall Street. The Dow, which had dropped as much as 180 points on the day, ended down 71 points, or 0.4%. The S&P 500 fell 0.4%, and the Nasdaq lost 0.5%. Meanwhile, U.S. economic data continued to show an improving economy. The number of people who applied for unemployment benefits in the first week of July fell to a seven-year low.

United Continental Holdings Inc. (UAL) shares jumped 7.1% after the company’s revenue per available seat mile, a closely watched sales metric in the airline industry, increased by 3.5% in the second quarter from a year earlier.

On Friday, the earnings season kick off continues as Wells Fargo & Co. (WFC) reports before the opening bell. Look for market shifts as a response to corporate earnings announcements through the end of June. More than 140 companies in the S&P 500, including Citigroup Inc., JPMorgan Chase & Co., Goldman Sachs Group Inc. and Johnson & Johnson, will report quarterly results between now and July 23, according to data compiled by Bloomberg.

The Nikkei 225 index (NIK) fell 0.6%, but other Asian markets were flat or slightly higher today. Chinese exports for June rose 7.2% in June from a year earlier, far below the 10% rise expected from economists surveyed by The Wall Street Journal.

Our 10 ETFs in the Spotlight meandered lower and no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

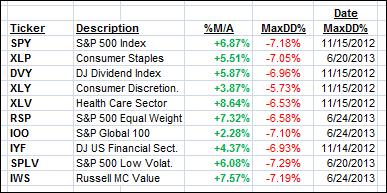

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

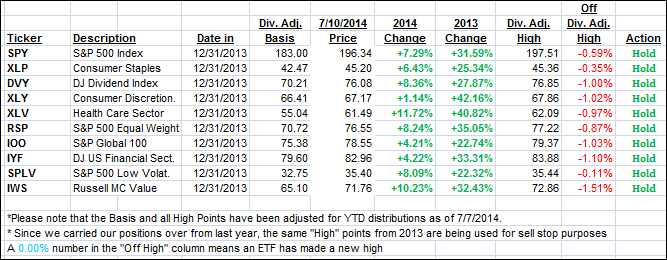

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) showed a mixed picture as the International one seems to lose steam at an accelerated rate. Both, however, remain on the bullish side of their respective trend lines:

Domestic TTI: +3.02% (last close +3.31%)

International TTI: +2.92% (last close +3.51%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli