ETF/Mutual Fund Data updated through Thursday, May 9, 2013

If you are not familiar with some of the terminology used, please see the Glossary of Terms.

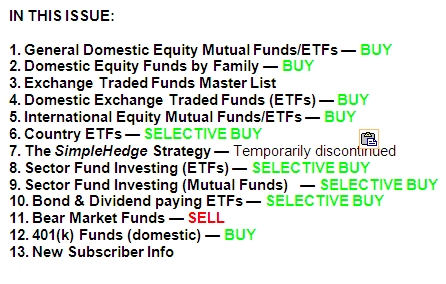

1. DOMESTIC EQUITY MUTUAL FUNDS/ETFs: BUY — since 10/25/2011

The domestic TTI broke through its long-term trend line generating a Sell for this area effective 8/9/2011. Over the recent past, we’ve seen the TTI hovering slightly below and above this dividing line between bullish and bearish territory. The clear break to the upside occurred on 10/24/11 and, effective 10/25/11, a new Buy signal for domestic equities went into effect.

As of today, our Trend Tracking Index (TTI—green line in above chart) has bounced off its long term trend line (red) by +4.72% as part of the post election rebound.

To avoid a potential whip-saw, a Sell signal to move out of all domestic equity positions will be generated once we have clearly pierced the line to the downside. Be sure to tune into my blog for the latest updates.

The link below shows the top 100 domestic funds (out of 674) and the sorting order is by M-Index ranking. Prices in all linked tables are updated through 05/09/2013, unless otherwise noted. Price data not yet available at publication is indicated with 00.00% or -100.00%.

Whenever the TTI is above the trend line, and therefore in ‘Buy’ mode, you can either use the tables in the links below to make your selections or choose one of the Model Portfolios featured every Wednesday:

http://www.successful-investment.com/SSTables/DomFundsTop100_050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/DomFundsTop100_050913.xls

2. DOMESTIC FUNDS BY FAMILY: American Century, Fidelity, Vanguard, ProFunds, Rydex, T. Rowe Price — BUY

http://www.successful-investment.com/SSTables/DomFFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/DomFFs050913.xls

3. EXCHANGE TRADED FUNDS MASTER LIST

As per request, I have added this ETF Master list so that you can quickly compare various ETFs without having to reference other tables. The ETFs listed in the table (476) consist of the following orientations: Domestic, International, Country, Sector and Specialty. Momentum figures for all ETFs are not adjusted for dividends.

Please note that I have moved all bear market ETFs to section 11, where they are listed alongside the bear market mutual funds.

http://www.successful-investment.com/SSTables/ETFMaster050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/ETFMaster050913.xls

4. DOMESTIC EXCHANGE TRADED FUNDS (ETFs): BUY

ETFs are an excellent alternative to No Load Mutual Funds. They are a valid choice to high mutual fund management fees, restrictive trading and redemption charges, which have been a problem for years.

All the same Buy and Sell rules apply for domestic ETFs as they do for domestic equity mutual funds in section 1.

http://www.successful-investment.com/SSTables/DomETFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/DomETFs050913.xls

5. INTERNATIONAL EQUITY MUTUAL FUNDS/ETFs: BUY —since 08/21/2012

This index gapped above its long term trend line to the upside and is now positioned at +9.38%. As always, I recommend you use my suggested 7% trailing sell stop in order to limit downside risk, should the trend reverse all of a sudden.

The listings in the link below represent some of my choices of the international funds I track to be used during a Buy cycle. Please note that I have added Vanguard, Fidelity, T. Rowe Price, Rydex/ProFunds and American Century Funds. They are sorted by M-Index ranking:

http://www.successful-investment.com/SSTables/InternFunds050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/InternFunds050913.xls

Be advised that many international funds may not be available to you since they carry a load. However, while I am able to purchase these for my managed account clients as ‘load waived’ funds, this doesn’t help you much, if you do your own investing. This is why I have included some appropriate ETFs in the above list.

6. COUNTRY ETFs: SELECTIVE BUY

While I believe that the United States is the greatest country in the world to live in, it is not necessarily always the best, or only one, to invest in.

This addition to my newsletter will allow us to also invest selectively in countries with better performing stock markets. With the proliferation of ETFs over the past years, we are now able to invest in a variety of countries using low cost index ETFs.

The chart shows the China Index as an example:

The link contains a list of various countries/regions, which I am tracking weekly. Please note that data in this table does not include adjustments due to distributions.

http://www.successful-investment.com/SSTables/CountryETFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/CountryETFs050913.xls

As you witnessed during the last couple of years, country funds can be volatile and the use of a trailing stop loss (I use 10%) is imperative to protect your portfolio from severe downside moves.

7. THE SimpleHedge STRATEGY: Temporarily discontinued

8. SECTOR FUND INVESTING (ETFs): SELECTIVE BUY

To diversify our portfolios, we always need to look for different opportunities to invest our money. The table of sector fund listings (ETFs) in the following link covers a broad spectrum of possibilities. The sorting order is by M-Index:

http://www.successful-investment.com/SSTables/SectorETFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/SectorETFs050913.xls

I personally invest no more than 5%-10% of portfolio value in any one sector and use a 10% trailing stop loss to minimize the risk.

9. SECTOR FUND INVESTING (Mutual Funds): SELECTIVE BUY

If you prefer using Fidelity’s wide variety of excellent sector funds, you will like this new addition. Here as well, sectors can be volatile, and I advise the use of a sell stop just as we do with ETFs.

The sorting order is by M-Index:

http://www.successful-investment.com/SSTables/SectorMFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/SectorMFs050913.xls

10. BOND & DIVIDEND ETFs: SELECTIVE BUY

If you prefer using ETFs for the generation of income, here’s a list of bond and dividend paying ETFs. It’s important to first look at how these instruments have held up in terms of momentum figures. Then you should visit your favorite financial web site to examine yield and other details.

Please note that data in this table does not include adjustments due to distributions.

http://www.successful-investment.com/SSTables/Bond_DivETFs050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/Bond_DivETFs050913.xls

11. BEAR MARKET FUNDS: SELL

The above indicator represents our Short Fund Composite (SFC) to be used as a trend indicator for Bear Market Funds.

The SFC has now broken below its long-term trend line by -11.70%, which means we are in bearish territory. As in the past, I will not take any action until the domestic TTI (section 1) has clearly broken into bear market territory. My preference is to work with a hedged position, or remain in cash/bonds, as opposed to an outright short one.

Below are the most commonly available bear market funds/ETFs and their momentum figures:

http://www.successful-investment.com/SSTables/BearFunds050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/BearFunds050913.xls

Please note that some of the above funds try to outperform the index they are tied to by the percentage stated. While this can enhance your returns it can certainly accelerate your losses as well. No matter which way you choose, be sure to work with a trailing sell stop and be aware that volatility will be your constant companion.

12. 401(k) FUNDS (domestic): BUY

The list (featured in the link below) displays commonly held 401(k) domestic equity mutual funds showing their latest momentum figures to go along with the Buy and Sell signals of the TTI in section 1. The same stop loss rules apply here as well.

Since fund choices are limited in any 401k plan, be sure to roll your assets into an IRA if you leave your job. Let me know if you need help with that.

In the meantime, however, you can benefit greatly by at least not buying the worst fund at the wrong time. If you follow our plan, you will never again buy one of those highly volatile sector funds, when you really should be out of the market altogether.

The sorting order is now also by M-Index.

http://www.successful-investment.com/SSTables/401k050913.pdf

Spreadsheet version: http://www.successful-investment.com/SSTables/401k050913.xls

13. New Subscriber Information

To get you a head start on more successful investing, please click on:

http://www.successful-investment.com/newsletter/How_to_use.pdf

and download our “How to use” information sheet and recent “Buy Signal” information:

http://www.successful-investment.com/weekly/BuySignal042803.pdf

The use of Trailing Sell Stops is an important ingredient to a successful trend tracking strategy. Download my complete 70 page PDF file on the subject at:

http://www.successful-investment.com/SellStopDiscipline.pdf

DISCLAIMER

(c) Copyright Successful-Investment.com, 2003. All rights reserved. No portion of the above message may be republished, retransmitted or forwarded without our express written consent. Violation of this copyright may result in service cancellation. Use and/or reliance on this service are strictly at the subscriber’s own risk. Subscriber must maintain compliance with our Terms and Conditions. We will not be liable for the acts or omissions of any third party with regards to delay or non-delivery of the ‘Successful-Investment’ notification. We shall not be liable for incidental, indirect, special or consequential damages or for lost profits, savings or revenues of any kind, whether or not we have been advised of the possibility for such damages.

Ulli G. Niemann is a registered investment advisor pursuant to the California Department of Corporations. The information presented herein is for informational purposes only and does not constitute an offer to sell securities or investment advisory services. Such an offer can only be made in those states we have established a “notice-filing” status or where an exemption from notification is currently available under the de minimis exemption rule.

The investment advisor is an independent advisor and receives no compensation from any corporations, brokerage houses, organizations or special interest groups by making recommendations to purchase any of the investment products used. The advisor is a fee-only advisor and receives no commissions for client trades.

Contact Ulli

Comments 3

The following is, I believe, an exhaustive list of all the Rydex mutual funds. I would appreciate your revising your list to reflect the up to date names, and also including those funds (like RYJHX) that have not been included thus far.

Banking RYKIX

Basic Materials RYBIX

Biotechnology RYOIX

Commodities Strategy RYMBX

Consumer Products RYCIX

Dow 2x Strategy RYCVX

Electronics RYSIX

Emerging Markets 2x Strategy RYWVX

Energy RYEIX

Energy Services RYVIX

Europe 1.25x Strategy RYEUX

Event Driven and Distressed Strategies RYDSX

Financial Services RYFIX

Government Long Bond 1.2x Strategy RYGBX

Health Care RYHIX

High Yield Strategy RYHGX

Internet RYIIX

Inverse Dow 2x Strategy RYCWX

Inverse Emerging Markets 2x Strategy RYWYX

Inverse Government Long Bond Strategy RYJUX

Inverse High Yield Strategy RYIHX

Inverse Mid-Cap Strategy RYMHX

Inverse NASDAQ-100® 2x Strategy RYVNX

Inverse NASDAQ-100® Strategy RYAIX

Inverse Russell 2000® 2x Strategy RYIRX

Inverse Russell 2000® Strategy RYSHX

Inverse S&P 500 2x Strategy RYTPX

Inverse S&P 500 Strategy RYURX

Japan 2x Strategy RYJHX

Leisure RYLIX

Managed Commodities Strategy RYLFX

Managed Futures Strategy RYMFX

Mid-Cap 1.5x Strategy RYMDX

Multi-Hedge Strategies RYMSX

NASDAQ-100® RYOCX

NASDAQ-100® 2x Strategy RYVYX

Nova RYNVX

Precious Metals RYPMX

Real Estate RYHRX

Retailing RYRIX

Russell 2000® RYRHX

Russell 2000® 1.5x Strategy RYMKX

Russell 2000® 2x Strategy RYRSX

S&P 500 RYSPX

S&P 500 2x Strategy RYTNX

S&P 500 Pure Growth RYAWX

S&P 500 Pure Value RYZAX

S&P MidCap 400 Pure Growth RYBHX

S&P MidCap 400 Pure Value RYAVX

S&P SmallCap 600 Pure Growth RYWAX

S&P SmallCap 600 Pure Value RYAZX

Strengthening Dollar 2x Strategy RYSBX

Technology RYTIX

Telecommunications RYMIX

Transportation RYPIX

U.S. Government Money Market RYFXX

U.S. Long Short Momentum RYSRX

Utilities RYUIX

Weakening Dollar 2x Strategy RYWBX

IRA,

Thanks for your efforts, but I was looking to change only the currently listed funds. Unfortunately, my programmer tells me that we have reached certain limitations and can’t add your suggested list. We may even have to reduce some of the mutual fund listings. Again, as I mentioned, our priority are ETFs, which is where our focus will remain. Sorry that I could not be of more help.

Ulli…

Ira,

I was able to update the descriptions of the Rydex funds currently listed. See next Thursday’s StatSheet for the update.

Ulli…