The winning streak came to an end on Thursday, as major U.S. indices closed the trading day in negative territory with currency exchange rates grabbing headlines. The market did overcome early morning lows in the wake of some mixed economic data from both sides of the pond.

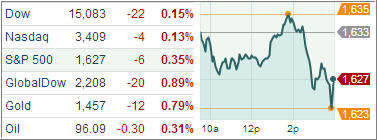

The Dow Jones Industrial Average was 22 points lower at 15,083, the Standard & Poor’s 500 Index decreased 6 points to 1,627, and the Nasdaq Composite lost 4 points to 3,409.

The first big news of the day was the jobless claims number. Initial claims for unemployment insurance fell 4,000 last week to 323,000, the lowest level since January 2008, and below the consensus of 335,000. The four-week average of claims fell 6,250 to 336,750, the lowest level since November 2007, indicating a steady downward trend in firings. A level below 400,000 is consistent with moderate payroll growth.

Elsewhere, U.S. wholesale inventories rose but sales fell. Wholesale inventories rebounded 0.4% in March, versus the 0.3% growth forecasted by economists. However, sales dropped 1.6%, the most since March 2009. Autos, hardware, machinery, and apparel posted sizable gains, while petroleum declined (mostly reflecting lower prices). The decline in goods imports suggests weaker wholesale inventories growth over the next 5 months.

Overseas, UK stocks also gained ground even as the Bank of England (BoE) kept its benchmark interest rate unchanged at 0.50%, holding off on adding to its asset purchase program. In Asia, the Bank of Korea unexpectedly cut its benchmark interest by 25 bps to 2.50%, joining a recent plethora of easing efforts from global central banks. The surprising rate cut came as strength in the Korean won, exacerbated by the recent sell-off for the Japanese yen, threatens the nation’s key export business outlook. China’s producer price inflation data came in weaker-than-expected for April, suggesting weak demand.

The U.S. dollar rose to its highest against the yen in over four years on Thursday, blasting through the 100-yen level. Investors sold the low-yielding yen as ongoing support from central banks around the world continues to push cash into higher-yielding assets. Although stocks slipped today, the major uptrend remains intact.

Our Trend Tracking Indexes (TTIs) pulled back as well but remain solidly above their respective long-term trend lines by +4.72% (Domestic TTI) and +9.38%.

For the latest charts and momentum figures, please review the most recent StatSheet, which I will post within a couple of hours.

Contact Ulli