ETF/No Load Fund Tracker Newsletter For Friday, October 14, 2011

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, October 14, 2011

Bullishness Bolsters Equity ETFs, But For How Long? Upper End of Trading Range Reached!

For a second straight week, markets moved to the upside even amidst Eurozone uncertainty and mixed economic indicators on a global scale. After a couple relatively flat days, market optimism skyrocketed in today’s session, with the S&P jumping up 1.74% while gaining 5.74% for the week. Also, the VIX dropped 8% to 28.24, showing a sharp pullback in volatility.

This might have you craving equities once again and brings up the question “where are we now?”

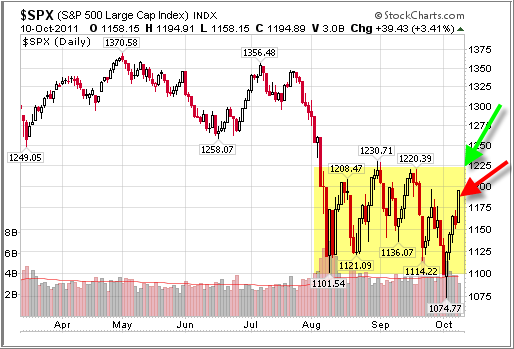

For weeks, I have been talking about the broad sideways pattern the markets are locked in to. The low end, on the S&P 500, is in the 1,100 to 1,120 area, while the upper end has put a lid on past advances in the 1,220 to 1,230 range. Last Tuesday, I posted the following chart with the red arrow showing the current position:

With the rally having continued since, we have now reached the upper end of the trading range, give or take a few points (green arrow).

That means that a clear breakout above the recent high of 1,230.71 could mean a resumption of the previous uptrend. This goes along with my Domestic Trend Tracking Index (TTI), which currently sits in the following position:

Domestic TTI: +1.53% (last week -0.62%)

This indicator has broken above its long-term trend line (again), but has not taken out its previous high point (see chart in current StatSheet).

Some sector ETFs have crossed their respective trend lines to the upside and have remained there for a few trading days, which will make them a prospective buy next week. Short of any major reversal, I will get my feet wet with a couple of sector selections.

Yes, I know, while this week shined some positive light on Europe, I still remain very cautious on the potential impact of Eurozone weakness, as further evidenced by Spain’s debt downgrade yesterday. Though Slovakia finally passed the measure to expand the EFSF after much political deliberation, more bad news has come to the forefront.

The ongoing G20 meetings are highlighting an air of desperation, illuminating deeper issues in Europe requiring outside assistance. Some proposed doubling the size of the IMF, which already has $380 billion, although major players, including the U.S., are headstrong in their opposition. It’s clear that Europe can’t sustainably help itself and is in dire need of a global bailout, which could rock markets hard if it comes to fruition.

Although Greek default talks have subsided a bit in the last few days, European leaders have recognized the increasing severity of the situation, suggesting a 50% haircut on Greek debt. On the other side of Europe, Portugal claimed it was nearing “national emergency” as it tries to receive $78 billion in aid from the EU and the IMF to relieve its budget shortfall. This week’s talks of a strategy to uplift European banks might have some basis, but until I see it, I can’t necessarily believe it.

These are the fundamentals, yet the markets are climbing a wall of worry as they seem to do from time to time. If this breakout actually occurs, and the Domestic TTI closes in on the +2% level, I will have to issue a new ‘Buy’ for domestic equities.

While I think that this entire Europe situation will end up badly, and my current visit here in Germany along with observing vital news reports, has not changed my mind, the markets seem to ignore reality and are locked into hope for a solution.

This trend could go on, or could end abruptly but, if it continues, we need to participate when our indicators give the go ahead. We’re right at that point and next week’s host of earnings reports and economic data points may very well have us partially back in the market but, as always, any positions will be subject to our trailing sell stop rules.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader John:

Q: Ulli: Most of our retirement money is in my wife’s federal Thrift Savings Plan. A few weeks ago, we moved everything there into the most conservative fund available, the G fund, which is a mutual fund of government securities; there is no money market fund.

For non-TSP investments, wouldn’t it make sense to similarly move into treasuries ETFs/MFs rather than money market funds, since the latter currently pay almost no interest? If I wanted to do this, are there other suitable government-securities funds that deal in something other than treasuries?

A: John: Whatever you are comfortable with. The key here is, when the bear strikes, to be out of the market and in the safety of funds without market risk. Returns are immaterial; what matters is trying to keep your portfolio intact and not go down with the masses of investors. Always remember 2008.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli