Here is a quick ETF review of the past week’s winners and losers from my High Volume ETF Master list:

After the markets continued their ascent towards the upper end of the trading range with utter abandon, it’s no surprise that this week’s Leaders showed impressive gains.

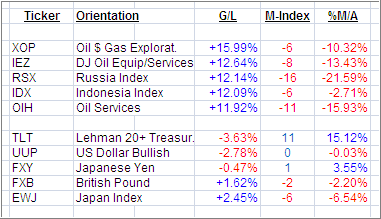

Oil related ETFs lead the pack followed by a couple of country ETFs. Before you consider any of this week’s strong performers as a reason to jump back in, keep in mind that most are not in the bullish zone yet as the negative M-Index shows.

More importantly, I have added the %M/A column (showing the percentage an ETF is above or below its long-term trend line), which demonstrates the fact that all of the Leaders are still stuck “below the line” and thereby in bear market territory.

Through my lens, the entire rally of the past 2 weeks has been nothing more than a recovery of the previous losses and a move from the bottom of the 2 month trading range back to the top, as I have commented on several times.

If you want to follow major trends in the market place, such as I advocate, you need to make sure that such a major trend has been established before taking action.

As I posted yesterday, we have now reached a critical point where we are at the cusp of a break out to the upside. Should that occur, I will start easing back into equities on a limited basis knowing that at any time a negative news event, especially from Europe, could send the bulls packing with the major indexes heading back south.

Since I can’t be certain when not if that event will take place, I have to stay in tune with the directional forces of the market as represented by my Trend Tracking Indexes (TTIs) and those sector/country ETFs that have broken above their own respective trend lines.

While fundamentals are fine in forming an opinion about the market, only actual trends will tell you whether you should be exposed to equity ETFs or not. Sometimes you will get a false signal, such as the bears did early last week, which is why it is imperative that you always work with a trailing stop loss to guard against excessive risk.

Disclosure: Client holdings in TLT

Contact Ulli