I found an interesting article discussing “Can You really Accomplish Everything You Need With One Single ETF?”

The story focuses on a new ETF (ONEF), the purpose of which is explained as follows:

Our firm wants to give small investors (under $100K in investable assets) access to the same professional portfolio management that high net-worth investors receive from their dedicated advisors, but at a fraction of the cost, packaged in a way that is easy to understand and buy and which follows the time tested approach of passive index investing.

ONEF would be suitable for someone looking for an all- in-one buy-and-hold stock fund that handles the asset allocation and securities selection for them. This single fund gives exposure to nearly the entire investable global equity market. It’s geared towards the 30-50 crowd – people that are still far from retirement – and most in need of long-term growth through stocks.

Obviously anyone who buys this fund is still on their own for fixed-income exposure. U.S. One hopes to also launch similar ‘one-and-done’ bond and balanced ETFs to provide a full range of investment solutions to small investors.

The idea here is to come up with an ETF for all seasons to find a solution for the buy-and-investor so he no longer has to worry about diversification. For the most part, diversification for the purpose of better weathering out bear markets is a useless endeavor.

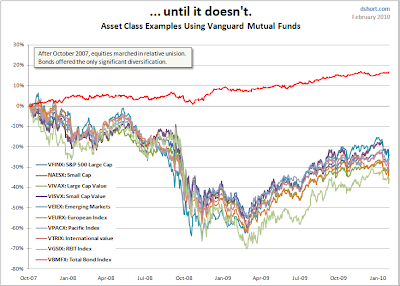

Sure, having a bond portion in such a portfolio can protect some of the downside. Doug Short of http://www.dshort.com said it best: Diversification works, until it doesn’t…

Doug’s chart makes it very clear that diversification in a typical Vanguard portfolio during a down market does not make much sense since all equity/international/emerging funds took at hit during the 2008 market massacre. While the bond portion saved the day, significant losses were still incurred.

As I posted yesterday, the far better solution is to not participate in the downdraft to begin with. For those following the trends, the sell date was 6/23/08, which you can easily identify in the above chart.

Back to the discussion. Can an investor with under $100k in assets use just one ETF? I believe so, but I don’t think ONEF is the one. It’s tiny with low volume and has no long term track record yet.

I don’t think there is any fund that can simply be held; any holding needs to be tracked and sold prior to bear markets developing. The last decade should have made that abundantly clear. Those investors looking for that one ETF that fits all circumstances will have a rude awakening at some time in the future.

I have found one no load fund, which I have featured before, that comes close to being held most of the time. However, in 2008 it also took a licking, but held up far better than the S&P; 500. Nevertheless, stepping aside would have been the right course of action.

It’s PRPFX, and in my advisor practice we use it all the time. It has been very steady, and, during the last year, never once came close to be stopped out via our trailing 7% sell stop discipline. While it will never be a top performer, the lack of volatility makes it an ideal candidate for the conservative investor. Since June 2008, it’s up over 16%, and it’s well suited as the only fund in a small portfolio—of course, subject to trend tracking and sell-stop rules.

While ONEF has to prove itself in the future, PRPFX is here now and has a long track record to boot.

Disclosure: Holdings in PRPFX