I came across another article (thanks to reader Nitin) in the NYT called “In Investing, Passive Beats Active.”

I came across another article (thanks to reader Nitin) in the NYT called “In Investing, Passive Beats Active.”

It’s the same old story, which makes the case for lower cost index funds beating actively managed mutual funds—most of the time. Sure, all things being equal, if I were a Buy-and-Hold investor, it would make sense to use a less expensive ETF over a more costly no load fund. If performance is very close, the lesser expensive vehicle would come out ahead over time.

However, as I said before, articles like this can create a false sense of security, in that an investor only looks at bull market performance and doesn’t realize that both vehicles will go down sharply in a bear market.

To give you a different perspective, and to add a dose of reality, I have included some of my actual Trend Tracking data for the past 6.5 years. The period covers our Buy and Sells from 10/13/2000 to 3/30/2007. However, I am obliged to state that past performance is no guarantee of future results.

Here’s the performance for the above 6.5 year period:

S & P 500: +3.41%

FDGRX: -12.53%

I used the widely held FDGRX fund as an example. You can plug in any fund you wish and see what answer you come up with. The data used for FDGRX were the adjusted closing prices as listed in Yahoo Finance.

This result obviously supports those in favor of index investing.

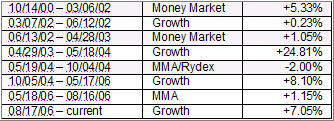

Next, I was curious to see if the extremely meager S&P; 500 Buy and Hold results could be improved, if an investor using this index would have invested using my Buy and Sell points for the same period. Here’s my actual Buy/Sell matrix:

I inserted the S&P; 500 figures and came up with a gain of almost 41%. In my advisor practice, we followed these Buys and Sells with actively managed no load mutual funds and the result was a gain of +53%. In this case, indexing lost out.

There you have it. If you’re using Buy & Hold, over time, including a bear market, you’ll be ahead using index funds as my example shows.

If you’re following trends, actively managed mutual funds (or a combination with indexes) appear to be the better solution based on the above data.

If you decide to play with this and insert your fund holdings, please share your results with me.

Comments 2

Hi Ulli,

I read you blog after I sent you my query about the cost of the funds. As I understand it active vs passive or index funds and active trend tracking are separate issues.

With trend tracking methodology one could select index funds and still be ‘active’ or vigilant and pull out of the bear market by trend tracking. One could be ‘passive’ at the ‘micro’ level by choosing index funds but ‘active’ at ‘macro’ level by trend tracking, unless index funds have prohibitive fees for ‘buy’ and ‘sell’. Therefore, for the people who use your approach, the choice should be active and passive funds and not active vs. passive funds.

Nitin

Absolutely true Nitin. I couldn’t have said it better myself.

Ulli…