- Moving the Markets

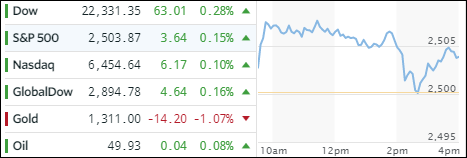

The major indexes zigzagged throughout the session but ended up on a sour note by trending towards the day’s lows. The S&P 500 managed to defend its 2,500 level successfully—so far. Not helping the bulls for the second day in a row was Apple (AAPL), which dropped another -1.72% causing the Nasdaq to surrender -0.51%.

It was the ‘morning after’ the Fed’s latest policy statement and investors were already getting nervous when news from bond market made the rounds that the Fed “may risk a misstep if it follows the current path.” That was enough to keep equities in a tight trading range all day.

On the ETF side, red numbers prevailed as well with the Dividend ETF (SCHM) faring the worst with -0.38% closely followed by the International SmallCaps (SCHC) with -0.36%. Bucking the downward trend were Aerospace & Defense (ITA) with a gain of +0.57% and Transportations (IYT) with +0.21%.

Interest rates stopped their ascent to higher levels with the 10-year bond yield slipping 1 basis point to 2.27%. Gold got hammered and lost the battle to protect its $1,300 level; at least for the time being. The US dollar (UUP) pulled back after yesterday’s large move higher by surrendering -0.29%.