- Moving the Markets

The major indexes, as well as equities in general, struggled through the session looking for some footing to use as a launching pad for the usual mid-day rebound. It worked for a while, as the unchanged line was conquered but upward momentum faded, and we closed in the red, although only fractionally. Earnings season got underway with the first batch of the banking sector reporting. Things were mixed so far, and the Financial sector ETF (XLF) dipped -0.76%.

The Transportation ETF (IYT) moved solidly higher with a gain of +0.67%. Second place went to the Dividend ETF (SCHD) with +0.13% followed by MidCaps (SCHM) with a meager +0.08%. The downside came into play today, but the losses were tiny. Semiconductors (SMH) gave back -0.21% while LargeCaps (SCHX) surrendered -0.15%. All in all, it appeared to be a market in waiting looking for a reason to bounce higher.

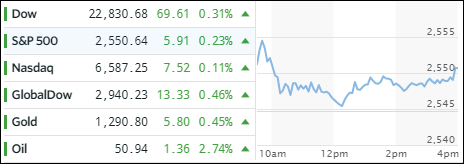

Treasury yields retreated again with the 10-year giving back 2 basis points. This helped the 20-year bond (TLT), which rallied +0.43%, to make up for some recent weakness. Gold attempted again to recapture its $1,300 level but fell short. Not falling short was the US Dollar (UUP), which bounced off its recent low in a successful attempt to stay above its 50-day M/A.