- Moving the markets

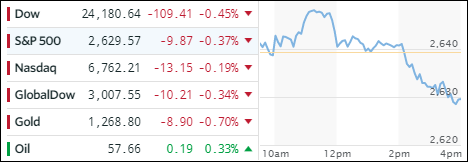

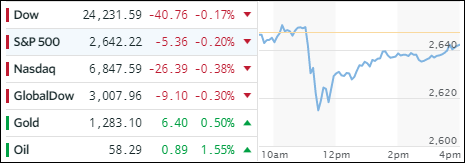

The Nasdaq powered ahead early in the session as the Dow and S&P 500 struggled to find some traction. However, the euphoria was short lived as mid-day selling pulled all three indexes lower and below the unchanged line.

Tranportations (IYT), who had put up some strong numbers in recent days, under-performed and lost -1.40%. Most ETFs ended up with red numbers as SmallCaps (SCHA) and Aerospace and Defense (ITA) gave back -0.96% and -0.80% respectively. The winner of the day ended up being Semiconductors (SMH), which remained unchanged. That’s was as good as it got.

Treasury yields were lower allowing the 20-year bond (TLT) to rally +0.50%, while the high yield complex (HYG) slightly dropped and stayed just below its 50-day M/A. The Dollar index (UUP) rallied today +0.16% but is stuck in a tight range for the past 5 trading days. Precious metals were slammed again with gold not only closing below its 200-day M/A but also touching lows last seen 4 months ago.