- Moving the market

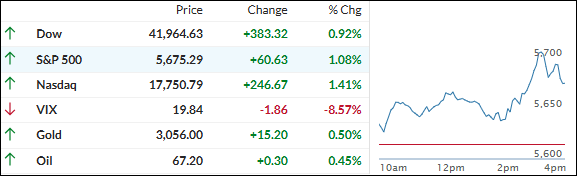

Equities surged after the opening bell as reports suggested that Trump might delay some of his broad tariff plans. Traders and algorithms quickly shifted to “Buy” mode, fueled by hopes that a global trade war could be averted.

Trump has indicated that tariffs target any country imposing duties on U.S. imports. However, the Wall Street Journal noted that the tariffs might be narrower in scope, focusing more on specific industries rather than broad impositions, with some nations potentially being excluded.

While Trump may show more flexibility in his approach, the situation remains fluid. For now, the effect on major indexes is positive and supportive. The markets also received a boost from Fed Chair Powell last week, who commented that any negative impacts from Trump’s tariffs would likely be short-lived.

Despite mixed results from the Services and Manufacturing PMIs, bond yields rose, and the indexes closed at their session highs, driven by an explosive short squeeze. Tesla, which had been struggling, managed a 12% comeback following reports that the FBI launched a task force to investigate the terror attacks.

Atlanta Fed President Bostic stated that inflation would be bumpy and not move dramatically towards its 2% target, which reduced expectations for rate cuts.

The dollar closed unchanged, gold slipped but found support at $3,000, and Bitcoin surged back above $88k to a three-week high.

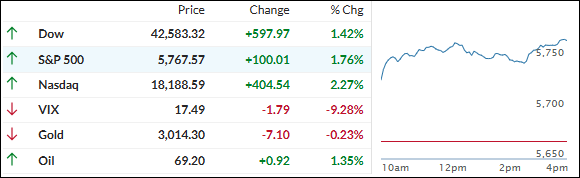

Could this be the beginning of the next leg higher based on historical precedent?

Read More