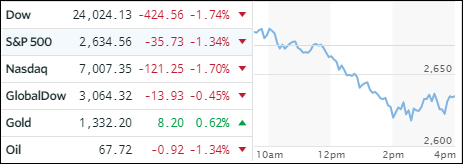

- Moving the markets

The tech sector took the lead during today’s rally, powered by FB’s strong results, which helped their shares to a solid +9.06% gain. While technology was the biggest gainer, 9 of the 11 primary S&P sectors finished higher. The loser of the day was telecommunications with -3.2%, which suffered due to AT&Ts poor results.

Interest rate concerns were pushed to the back burner as the 10-year bond yield slipped today and moved below its widely watched 3% level restoring a bit of calmness in the markets—at least for the time being. This benefited our Trend Tracking Indexes (TTI), which increased their safety margins to their M/As, meaning that a potential “Sell” signal is not imminent based on current numbers (see section 3 below).

While the tech sector appears to have found some footing, after it became clear that FB’s debacle of the last 45 days apparently did not affect their growth and user adoption, we might see some more upside over the next couple of days. That is until Apple Computers presents its report card on May 1. If their earnings are less than expected, thereby confirming recent stories about a reduction in demand, the tech euphoria might fade quickly.