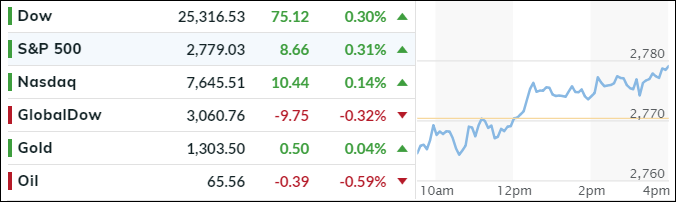

- Moving the markets

If you only watched the major indexes meandering around their respective unchanged lines and closing slightly in the green, except for the Dow, you missed out on the real action in some of the emerging markets.

The headlines did not cover equities but the wild activity in the foreign exchange markets (FX). The Bloomberg US Dollar index erupted to an 8-month high with UUP gaining +1.30%, which was its second largest gain YTD resulting in a huge tumble of the Euro, which had its biggest daily drop since the Brexit vote.

Emerging Market exchange rates got crushed, despite promises of intervention and other rescue efforts. However, nothing worked. Take a look at these charts demonstrating the demolishing of the Mexican Peso, Brazilian Real, Turkish Lira and Argentine Peso. (Hat tip goes to ZH for these charts).

Yet, domestically, all appeared calm as tech stock outperformed financials. Bonds rallied as yields retreated, after touching the 3% level yesterday, with the 10-year dropping 4 basis points to end the session at 2.94%.

Leave it to ZH to sum up this crazy day perfectly: “US stocks are higher, because European stocks are higher, because Draghi crushed the Euro, because he sees growth ending…”

It all makes perfect sense now…