- Moving the markets

The bulls were clearly in charge with the major indexes jumping right after the opening bell and remaining solidly above the unchanged line. The Dow shook off some of its recent weakness by scoring a triple digit gain and notching a third straight winning session, which put it back to slightly positive (+0.2%) for the year.

With 2/3 of economic activity coming from consumers to buy things they don’t need with money they don’t have, the Fed was delighted to present data showing that total consumer credit increased 7.6%, the fastest pace of credit growth since November. This came on top of Friday’s stronger than expected jobs report and assisted this euphoric rally, while, at least for the moment, any trade war anxieties were brushed aside.

As a result, two of the more depressed sectors showed signs of life, namely industrials and financials, which led the way to higher prices. This caused bond yields to climb with the 10-year adding 4 basis points to end the day at 2.86%.

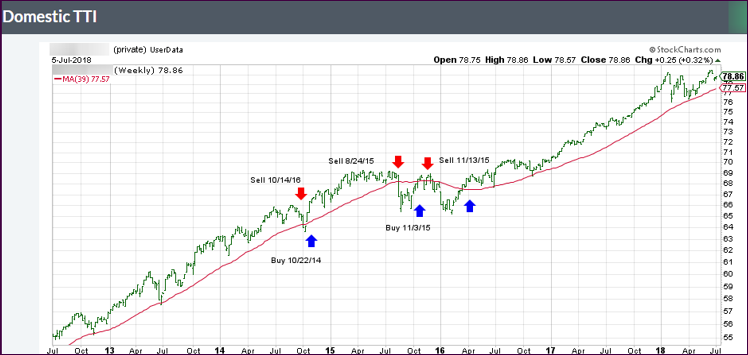

As I posted last week, bond yields and the S&P 500 remain out of sync, as this chart shows. They will eventually align, but there is no hard and fast rule as to how soon this will occur. We may very well see more upside momentum before some of this exuberance will dissipate.