- Moving the markets

After the relentless buying of the past few weeks, a pause was in order, as I posted last Friday, and that’s what we got today. The markets opened to the downside and never recovered, despite an attempt during the last few trading minutes to minimize the day’s losses.

Last week’s hype about a China trade deal evaporated in a hurry, as U.S. officials turned down an offer by China to hold a preparatory meeting on trade negotiations due to lack of progress.

Then, China posted its slowest pace of annual growth (6.6%) since 1990, while some of their communist leaders cautioned to be alert over a “black swan” or “gray rhino” financial event in the face of an economic slowdown…

Additionally, the IMF, International Monetary Fund, added to the gloomy global picture by noting that it had cut global growth from 3.7% to 3.5% but left the U.S. estimate unchanged at 2.5%.

Other economic data points were postponed due to the partial government shutdown, but grim Housing data were released showing that existing sales not only slowed to 3-year lows, but last month’s sales were down 6.4% and 10.3% lower than a year ago.

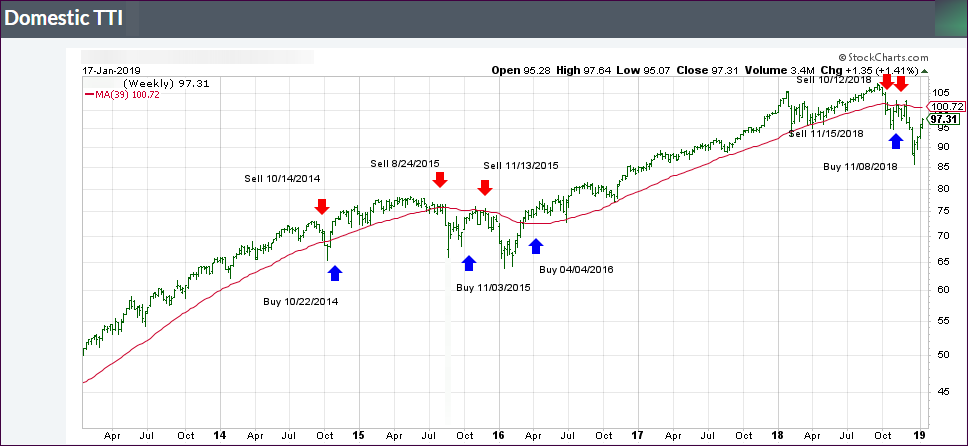

In the end, last Friday’s trade hope gains were wiped out again, while breadth in the markets was bad with 95% of S&P stocks closing to the downside today. This makes me contemplate whether it’s time for stocks to catch down to reality again, as this chart shows.