- Moving the markets

Sure, eventually there had to be a market pullback, as only hype and euphoria surrounded the U.S.-China trade talks with hard evidence of progress still seeming to be nebulous. This is what we saw today, as optimism about a concrete resolution simply faded.

An early rally vanished in a hurry with the Dow sinking at one point over 450 points, before a slow and steady comeback sharply limited early losses. I took the opportunity to add some sector ETFs to our holdings, as the major indexes were hovering deeply in the red.

The S&P 500 surrendered its hard fought for 2,800 level but only closed 8 points below it. However, more importantly, the index was threatening to break below its 200-day M/A, now seen as a support level, but it managed to reverse course and close safely, at least for the time being, above it by ~1.5%, as the afternoon bounce-back came to the rescue.

At this point, the S&P 500 is stuck in a quadruple top formation, and it is critical for this index to not only to regain its 2,800 marker but also to create further upside momentum. Otherwise, we might see a repeat downside performance, as shown by the previous 3 attempts, of which the third one was the most devastating, which led to the disastrous Q4 2018.

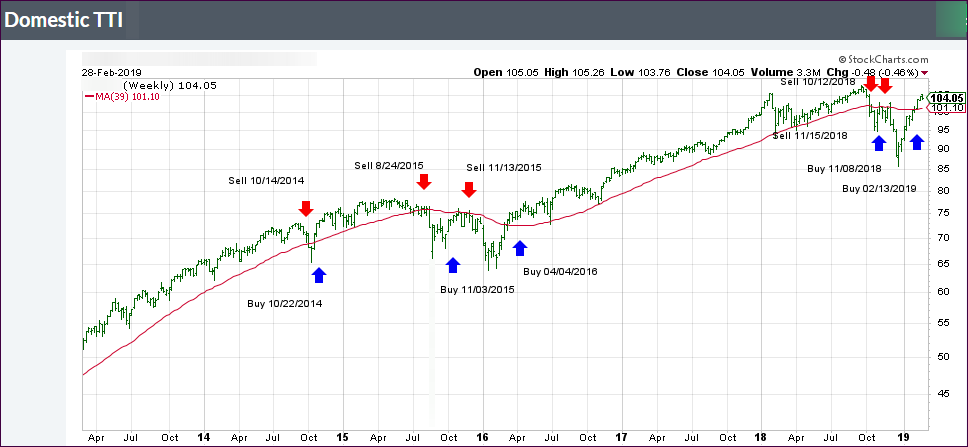

A variety of analysts and newsletters like ZH present this chart from time to time to serve as a reminder of where we might be and what could occur. Look at it and notice how close we are of repeating history.

Will it happen again? Who knows, but I feel that it is imperative to have an exit strategy in place, just in case a similar outcome sneaks up on us with the potential to absolutely pillage investment portfolios. After all, economic realities are far detached from current elevated equity levels.