ETF Tracker StatSheet

Pumping, Dumping and Pumping

[Chart courtesy of MarketWatch.com]- Moving the markets

An early rally petered out mid-day, but renewed investor optimism pulled the major indexes out of a hole and pushed them higher with the S&P 500 finally reclaiming and closing above the 2,800-resistance level for the first time in 4 months.

The Dow managed to close above the psychologically important 26k marker with both indexes snapping a three-day losing streak, while the Nasdaq notched its longest win streak since 1999 (10 weeks). All in the face of deteriorating econ data and rising interest rates.

The 10-year bond yield has broken out of a triangle formation and spiked upwards extending its rise from the past week causing the widely held 20-year bond TLT to drop -1.13%, which helped the U.S. Dollar rally and score a solid week.

Sure, hope for a conclusion of a U.S.-China trade deal reigned supreme but nothing concrete was announced, so we rallied primarily on hope, because other data points were less than awe inspiring. Mall operators announced some 300 store closings, which pushed some of their stock prices considerably lower.

As trend followers, however, we are only concerned with the long-term direction of the trend rather than what drives it. Nevertheless, it’s wise to look under the hood sometimes to see what might be behind it. These days, its hard to find sound reasons, as ZH pondered with these 4 charts: one, two, three, four.

Now you know what is, and is not, behind the relentless drive to higher prices with chart 4 being the master of the equity universe.

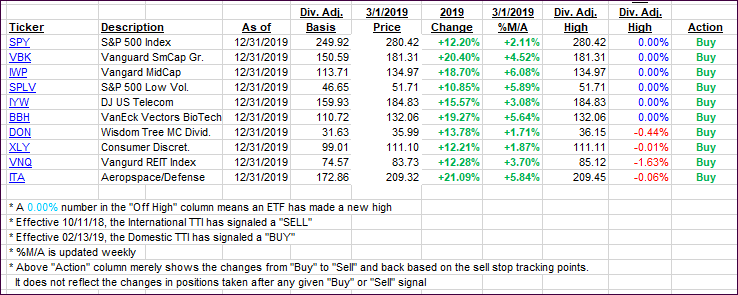

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how some our current candidates for this current ‘Buy’ cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) gained as the major indexes were in rebound mode.

Here’s how we closed 03/01/2019:

Domestic TTI: +3.59% above its M/A (last close +2.98%)—Buy signal effective 02/13/2019

International TTI: +1.30% above its M/A (last close +1.10%)—Buy signal effective 02/21/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli