- Moving the market

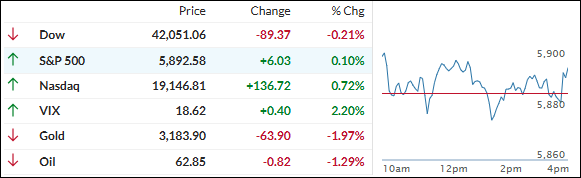

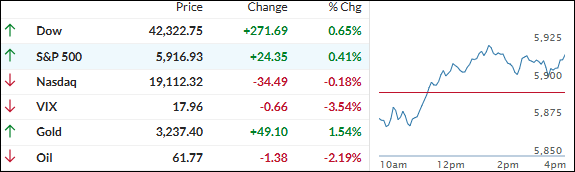

Equities opened lower as early optimism faded, with all three major indexes dipping into negative territory. The temporary suspension of the U.S.–China tariff dispute faded from focus, offering little support.

By the close, only the Dow and S&P 500 managed to claw back into positive territory, while the Nasdaq remained in the red.

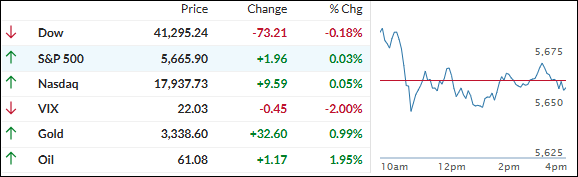

Investor sentiment remains cautiously optimistic. Recession fears have started to ease, helping lift markets, but a range of uncertainties continues to form a “wall of worry.”

The key question now is whether the current rally can broaden and sustain its momentum through the summer—or if it’s nearing exhaustion and vulnerable to a correction.

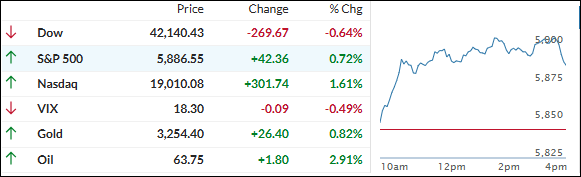

The tech sector has led the charge this week (excluding today), with standout performances from Nvidia and Tesla—both up over 14%. Meta, Amazon, and Alphabet have also posted solid gains.

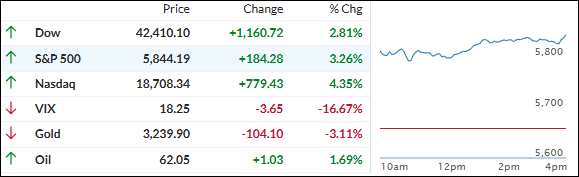

On the economic front, April’s Producer Price Index (PPI) surprised to the downside, falling 0.5% month-over-month versus expectations of a 0.3% increase.

Retail sales rose 0.1%, in line with forecasts. Despite the positive inflation data, Fed Chair Jerome Powell cautioned that inflation could remain volatile.

Interestingly, the inflation surprise index dropped to its lowest level since 2020, fueling gains across a wide range of assets—including stocks (excluding the Nasdaq), bonds, gold, bitcoin, and crude oil.

Meanwhile, global uncertainty remains elevated, with the World Uncertainty Index still at record highs, as noted by ZeroHedge.

Can equities break through this glass ceiling—or is a pullback looming?

Read More