- Moving the market

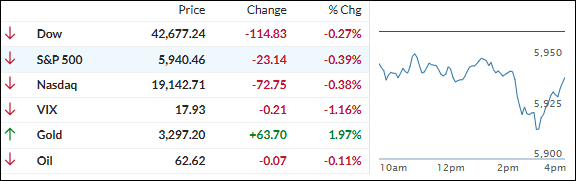

The markets opened on a weak note as rising bond yields and uncertainty surrounding the U.S. budget bill weighed on sentiment.

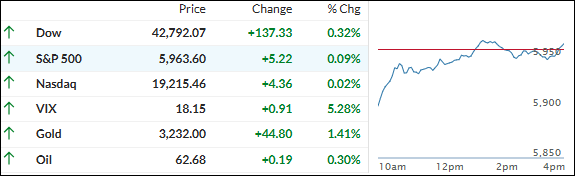

Traders remained focused on developments in Washington, where Republican leaders are working to finalize a bill aimed at lowering taxes while expanding deductions for state and local taxes. While potentially beneficial for taxpayers, the proposal could worsen fiscal deficits and reverse recent efforts at budgetary restraint.

Analysts expressed concern that the bill may do little to curb inflation or reduce national debt. These worries were reflected in the bond market, where yields climbed, pushing the 30-year back above the 5% mark. Confidence was further shaken by a poorly received 20-year bond auction, which reignited fears about bond market stability and drove yields even higher.

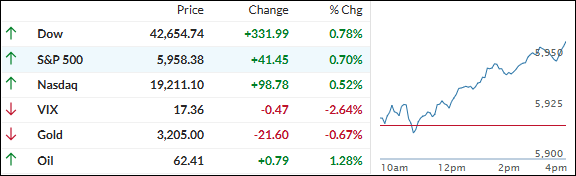

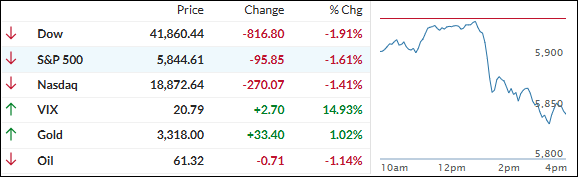

The spike in yields derailed a budding rally in equities. The major indexes reversed sharply into the close, with even the previously resilient “Magnificent Seven” stocks turning red. For the second consecutive day, retail dip buyers were notably absent—a trend highlighted by ZeroHedge.

As interest rates rose, the U.S. dollar weakened, gold reclaimed the $3,300 level, and Bitcoin surged to a new high of $109,500 before pulling back.

One analyst suggested that if Bitcoin continues to track global liquidity trends, it could reach $170,000 by August.

That’s a bold call—could he be right, or is this a case of irrational exuberance?

Read More