- Moving the markets

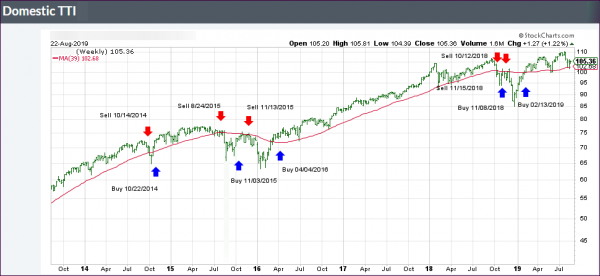

Despite an early sell-off, caused by the bond market flashing a recession signal, the major indexes managed to climb out of that hole supported by a lift from the energy sector, as oil prices showed new signs of life. Even with that good effort, we remain stuck in a trading range with the ceiling of the S&P 500 being in the 2,945 area, while the bottom lurks around 2,820.

That’s a huge range, in which we’ve been seesawing since early August. A push through the ceiling may bring all-time highs back into play, while a break below the bottom may cause the index to revisit its June lows of 2,728. The Dow as well is rangebound between its 100-day and 200-day M/As.

Better-than-expected earnings from Hewlett Packard and Tiffany helped to fuel the fire and kept the bullish rebound going. The only fly in the ointment was low volume, which is typical for the week ahead of Labor Day.

The big news came from the bond market with the 30-year Treasury Bond now yielding less than what the S&P 500 pays in dividends. ZH charted it like this. This is so unusual and has only occurred for about 3 months in the past 40 years.

It confirms that markets continue to be distorted beyond recognition.

Read More