- Moving the markets

I was watching the futures markets last night as the major indexes were getting hammered on a follow through move from Friday’s sell-off. Even early this morning, the Dow had plunged 200 points when Trump suddenly announced that “China called our trade people last night and said let’s get back to the table.” He then told reporters that China called his team not once but twice in a bid to restart trade talks.

While that sounded good on the surface, the only problem was that none of this happened, according to China. Whatever the case may be, the objective was accomplished in that the markets reversed and soared, as the computer algos did not care about remarks by the Global China Times editor that Trump indeed “hallucinated” the 2 phone calls…

No, I am not making this up, and it is not April Fool’s Day either, this is nothing more than a sign of the insanity that drives the markets nowadays. ZH actually went through the trouble of charting some of this early morning idiocy.

In the end, the intra-day meandering ended during the last hour of trading when the indexes shot up and closed in the green thereby delaying a potential ‘Sell’ signal for our Domestic Trend Tracking Index (TTI).

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

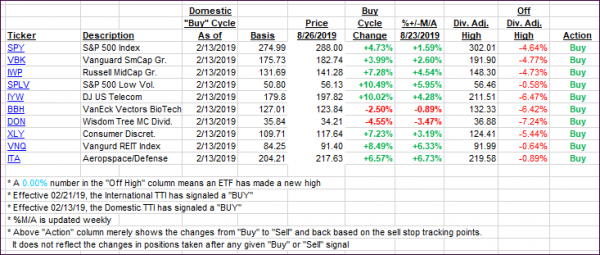

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered with the Domestic one now having reclaimed its long-term trend line for the time being.

Here’s how we closed 08/26/2019:

Domestic TTI: +0.78% above its M/A (prior close -0.10%)—Buy signal effective 02/13/2019

International TTI: -2.28% below its M/A (prior close -2.40%)—Sell signal effective 08/15/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli